Voucher registration

All bookkeeping in Xena starts with vouchers. The system simplifies the process by storing vouchers and automatically suggesting relevant information.

Inbox – Where Voucher Registration Begins

Voucher registration begins in the Inbox, where you'll find all unposted vouchers. These can come from various sources, such as:

- PDF invoices uploaded manually or received via email

- Electronic invoice files from Sproom or directly from suppliers

- Receipts submitted via the EG Xena Vouchers app

You can navigate quickly through the voucher using shortcut keys designed specifically for voucher registration.

➡️ View the shortcut key overview here.

Posting and Approval

If you have posting rights, you can enter and post the voucher directly. If not, you can fill in the required information and send it to a colleague for approval. Approval rules can also be set up to automatically forward vouchers to another user's inbox if you don’t have access to approve them entirely.

➡️ See the guide on setting up approval rules here

When a voucher is posted, it is assigned a voucher number based on the journal and the user performing the posting. Journals are created via:

Setup > Ledger setup > Ledger

➡️ Learn how to set up number series and assign ledgers to users

A Voucher in Xena Is Divided into Five Logical Sections

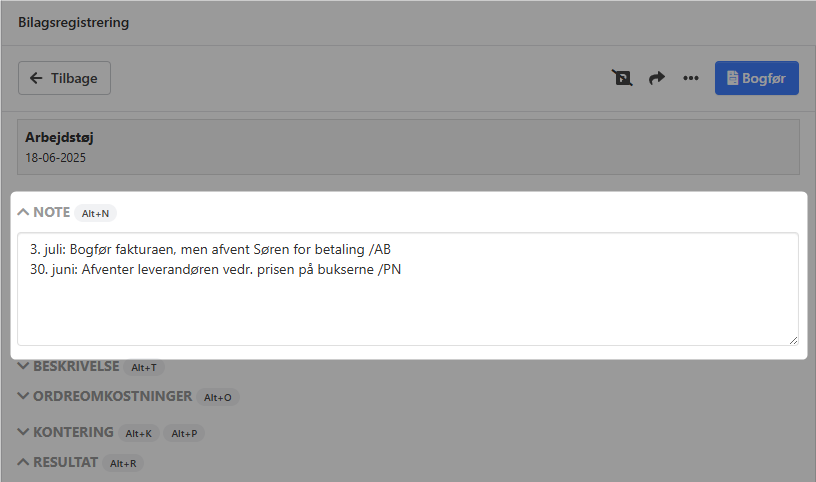

1: Notes

This section is for internal comments about the voucher. It’s a free text field with no fixed structure. The notes are stored with the partner entry during posting and are also visible under Purchases > Payments.

➡️ Learn more in the guide: Notes and parking of vouchers

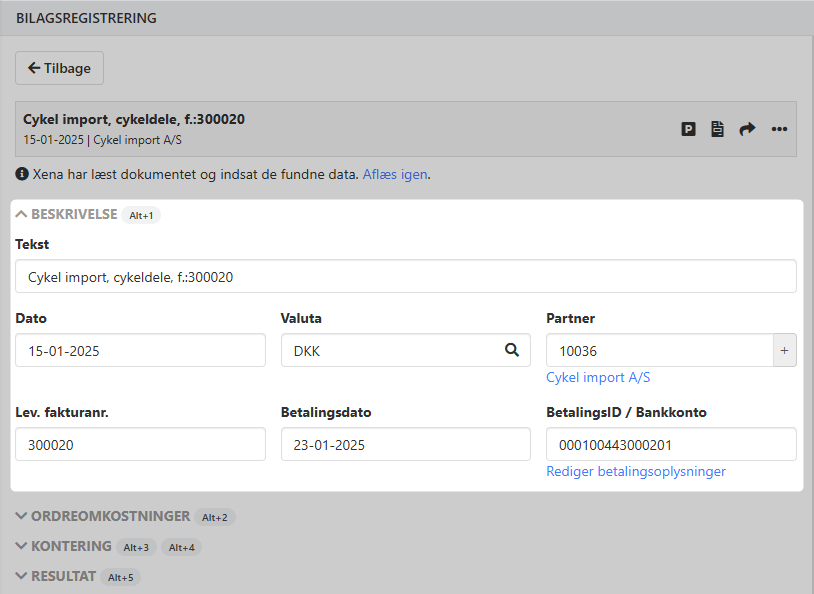

2. Description

Here you'll find all basic information about the voucher. Xena automatically extracts many of these details when the voucher arrives in the inbox.

The top line of text is used as the default description on subsequent posting lines. Therefore, it’s a good idea to write a clear and comprehensive description — this also makes it easier to find the document later.

➡️ See also: Document Management

Supplier Details:

If the supplier hasn’t been created yet, you can do so directly by clicking the "+" button in the Partner field. Even for cash purchases — e.g., from a bakery or café — it's recommended to create a supplier for easier tracking.

When creating suppliers, keep the following in mind:

- Always enter the org.number so Xena can recognize the supplier

- Do not reuse the same org.number for multiple suppliers

- Remove the org.number before deactivating a supplier

Once a supplier is selected, additional fields such as Invoice No., Payment Date, and Payment ID/Bank account appear — especially important when sending invoice payments to your bank.

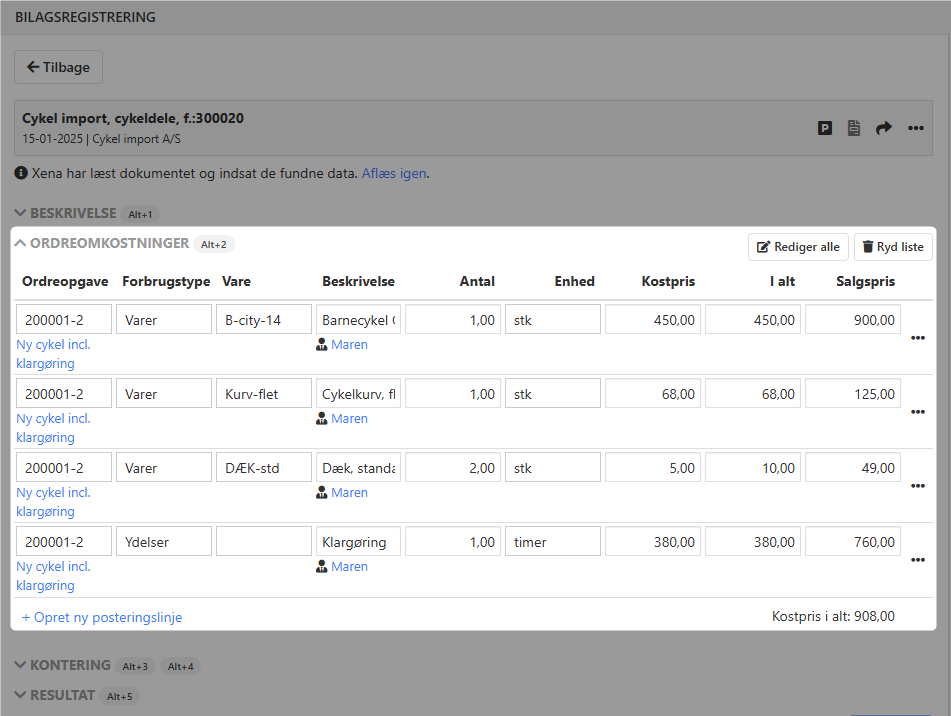

3: Order cost posts

In this section, you can add expense lines to sales orders. It only appears if at least one project exists in your accounts.

You can specify:

- Task

- Cost type

- Description

- Amount (excl. VAT)

➡️ The available tasks depend on their status and whether they are set up to be shown in bookkeeping.

Use the Edit All and Clear List buttons to update or remove order cost lines in bulk.

➡️ Also see:

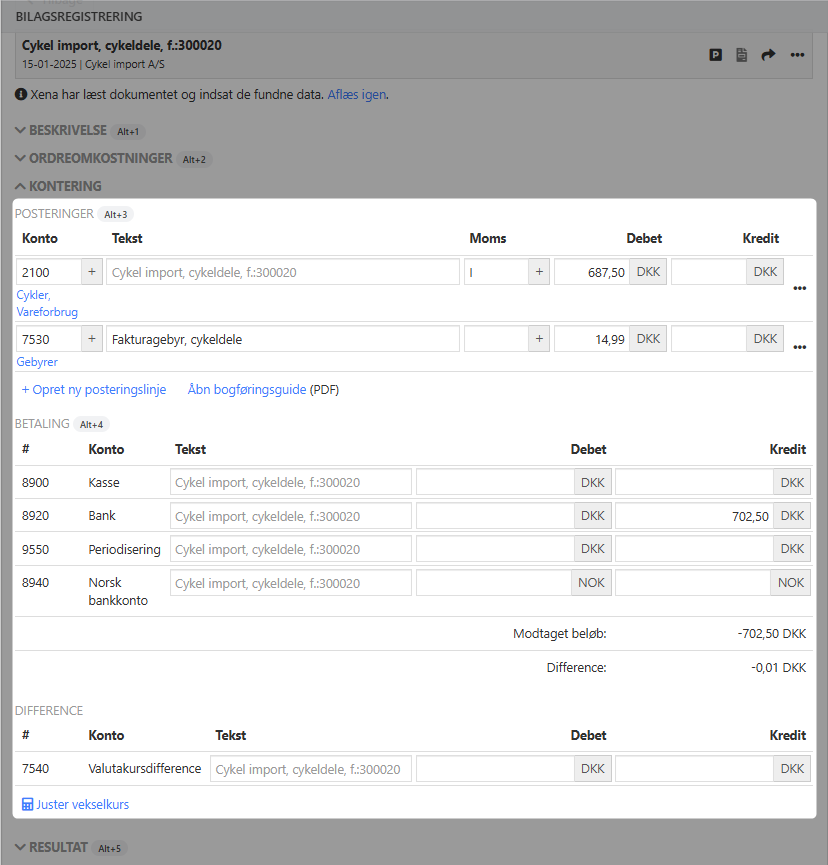

4. Posting (Accounting)

Here you define how the voucher should be posted:

- Select a general ledger account

- Enter the amount (incl. VAT)

- Optionally, add a description

If you often post vouchers from the same supplier to the same account, you can check the box Save posting details on the partner for next time — Xena will remember this setup.

Already paid?:

If the invoice is already paid, simply click the amount field next to the payment account — the total amount will be filled in automatically. For partial payments, you can adjust the amount manually; any remainder will be recorded as outstanding with the supplier.

The posting date is taken from the Payment Date field in the Description section, if available — otherwise, the Voucher Date is used.

Handling Foreign Currency:

If the invoice is in a foreign currency and exchange rates differ, you can adjust for exchange rate differences:

- Enter the paid amount under the relevant payment account

- Click Adjust Exchange Rate

- Xena will automatically match the invoice amount to the actual payment

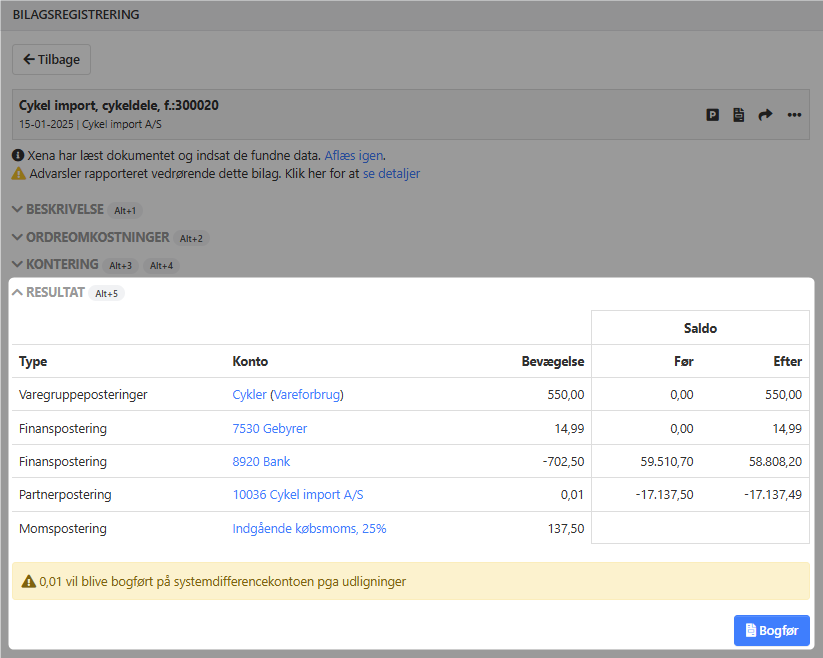

5. Result

This section provides an overview of the posting result. It also shows any errors or warnings:

- Errors (red): The voucher cannot be posted

- Warnings (yellow): The voucher can be posted but should be reviewed

Differences up to DKK 0.49 are treated as rounding and automatically posted to the System Difference account.

When everything is in order, click Bookkeep at the top of the screen. If any part of the voucher requires additional approval, it will be automatically forwarded to the appropriate user.

- Updated