VAT codes

Here's an explanation of how VAT codes work in Xena.

VAT Codes

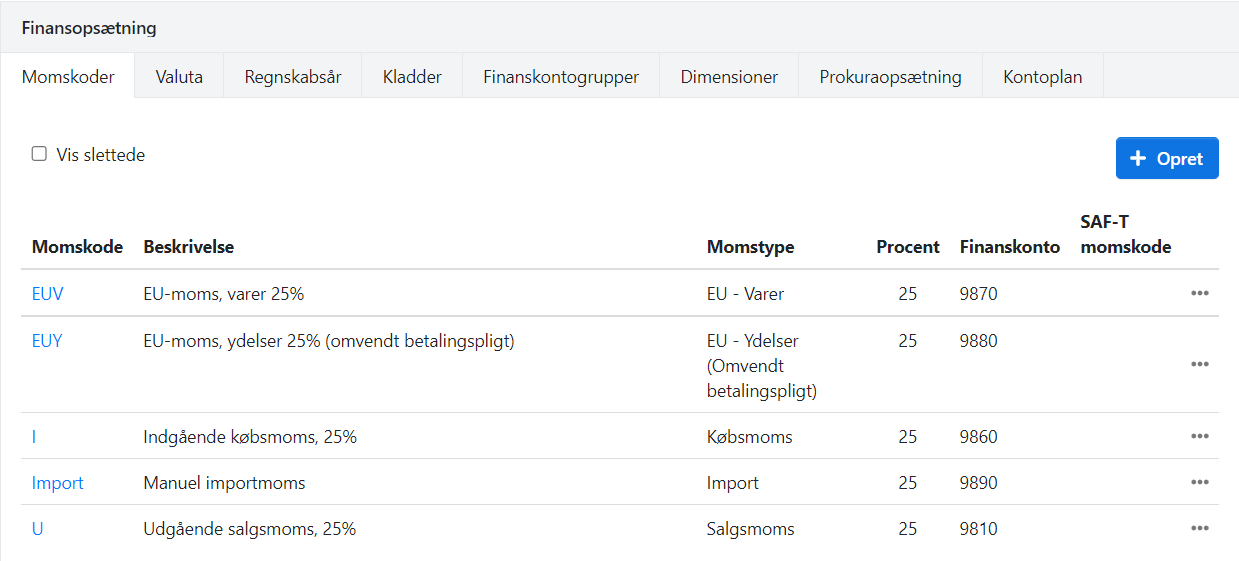

If you have created a Danish or Norwegian fiscal, the most common VAT codes for these countris are created. You find the VAT codes created in your fiscal in the menu Setup > Ledger Setup > VAT.

You can create extra VAT codes as needed and also edit the existing ones.

Standard Danish VAT codes in Xena:

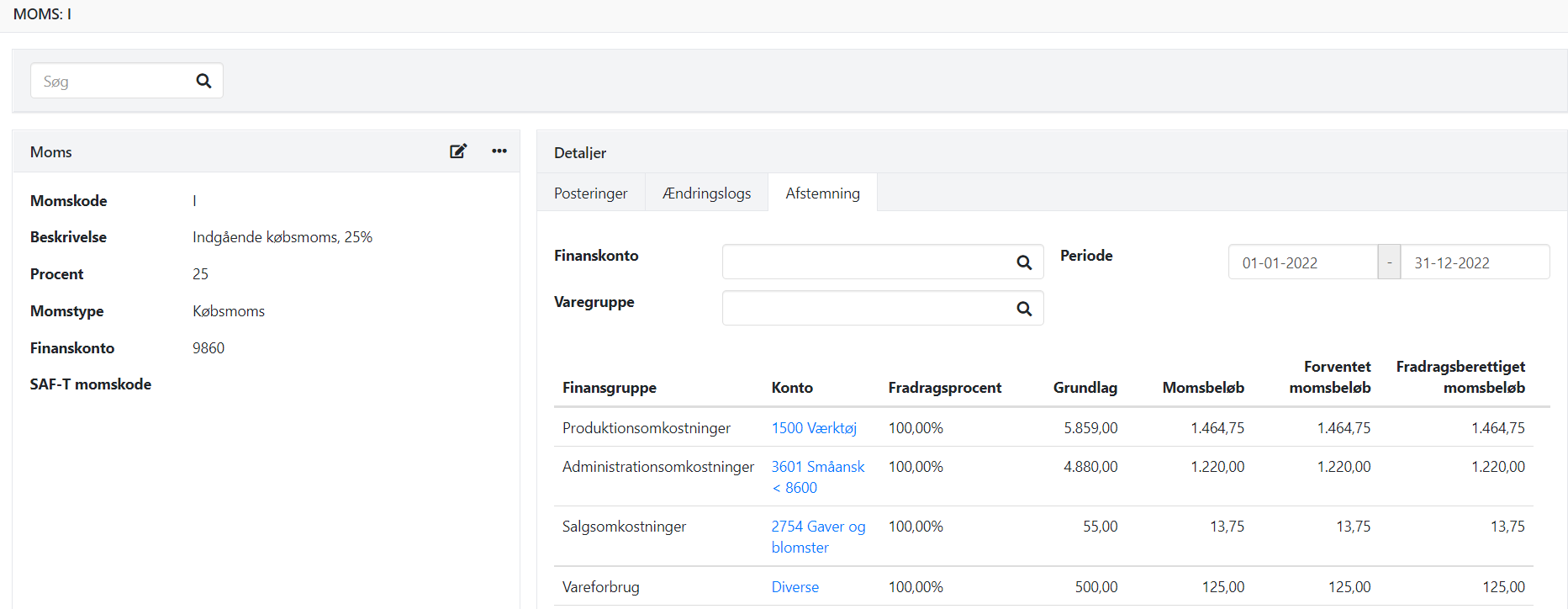

By clicking on a VAT code, you can view the details for that specific code, including:

- VAT code and description

- The applicable percentage

- Whether it's Purchase VAT, Sales VAT, EU VAT, etc.

- Financial account number

- SAF-T VAT code (to be filled with the Danish or Norwegian standard VAT codes)

EU VAT

As a company in EU, when buying/selling goods within the EU, specific rules apply, which Xena handles automatically. When posting an invoice/voucher for a Partner in an EU country, the VAT supplement and corresponding deduction will be posted automatically.

Purchase

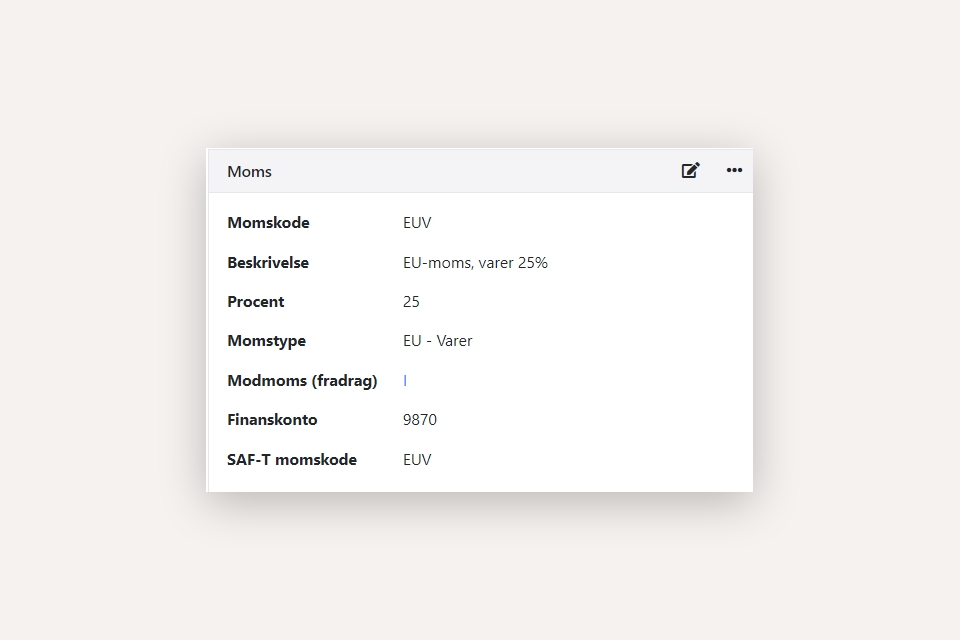

For posting purchases with EU VAT codes, the VAT is calculated as with a normal invoice, but it is simultaneously offset against the VAT code you have selected as Offset VAT on the EU VAT code.

Note: The default offset VAT for EU purchases is the common VAT code for purchase VAT, meaning they will be mixed with other purchase VAT. If you want the EU VAT to be offset against a separate input VAT code, you should set this up before posting on the VAT code.

Sales

When selling to a company with a VAT number in another EU country, you don't have to charge VAT. However, you should verify that the customer has a valid VAT number using the VIES system.

Remember to report sales to EU countries without VAT on the EU sales list for goods. You can find an overview of your EU sales without VAT through in the menu Ledger > VAT > VAT Settlement, select the tab 'EU sales without VAT.'

If the customer's VAT number is not valid, or if the recipient is a private individual, you should calculate Danish VAT for sales to foreign countries.

Import VAT and customs

When buying something outside the EU, the settlement for this is handled by Danish SKAT. This settlement can be done under the menu Ledger > VAT > Import VAT statement. The standard VAT code 'Manual import VAT' is used.

Read more: Importmoms

VAT Obligatory Sales Abroad

If you sell certain technology services to private individuals abroad, or if you sell a total of over 10,000 euros to private individuals in other EU countries within a calendar year, you have two options: either become VAT-registered in the respective country or settle foreign VAT with SKAT.

Read more: VAT One Stop Shop

Posting manual VAT

If you need to post a VAT amount manually, you need to first create financial accounts specifically for posting manual VAT. It's not possible to post directly on the VAT codes in Xena. Manually posted VAT will also be included in your VAT settlements.

Read more: Manual VAT

VAT Exempt Sales

Sometimes there is a need to sell something VAT-exempt, either the entire invoice (e.g., if it's sales to a foreign company) or individual items that are not subject to VAT (e.g., postage).

Read more: VAT-Free sales

- Updated