Import VAT and Customs Duty

Usually, when you import goods or purchase services from countries outside the EU, you are required to pay Danish VAT and possibly customs duty. This is referred to as Import VAT.

When you record import VAT, it does not affect your income statement. It is only when you also record customs duty that your results are impacted.

Below is an example of how you can record your import VAT + customs duty. If you are unsure about how to record import VAT in this manner, you can consult your auditor or bookkeeper.

Preparation

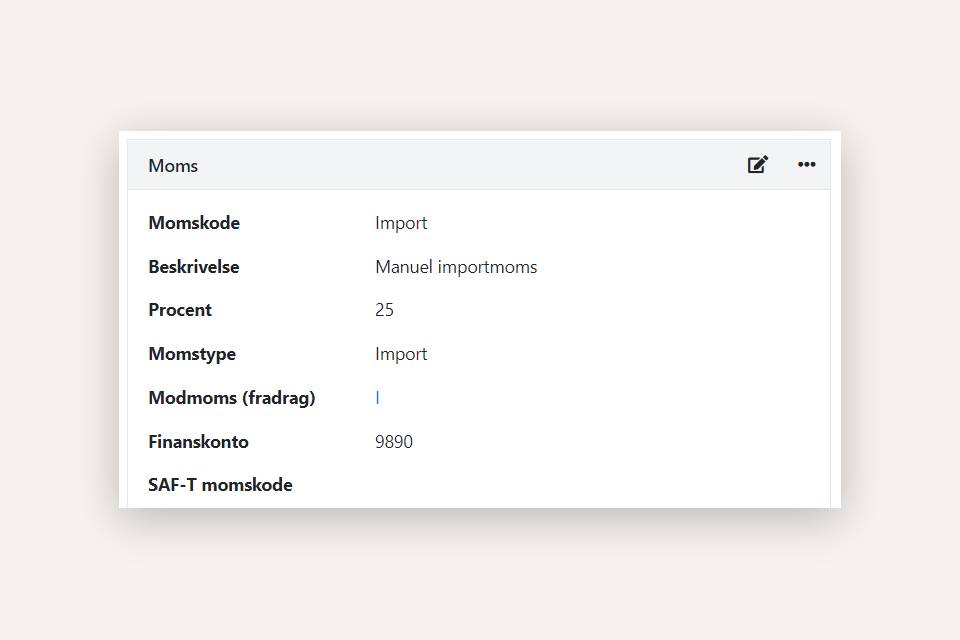

Before recording import VAT, make sure you have a tax code set up with the type 'Import VAT.' You can find your tax codes in the menu Setup > Ledger Setup, and select the tab 'Vats'.

Typically, you can simultaneously deduct the VAT as input tax, so remember to set a contra-VAT account for the tax code (e.g., input VAT).

Here's an example of a created import VAT tax code:

Bookkeep Import VAT and Customs Duty:

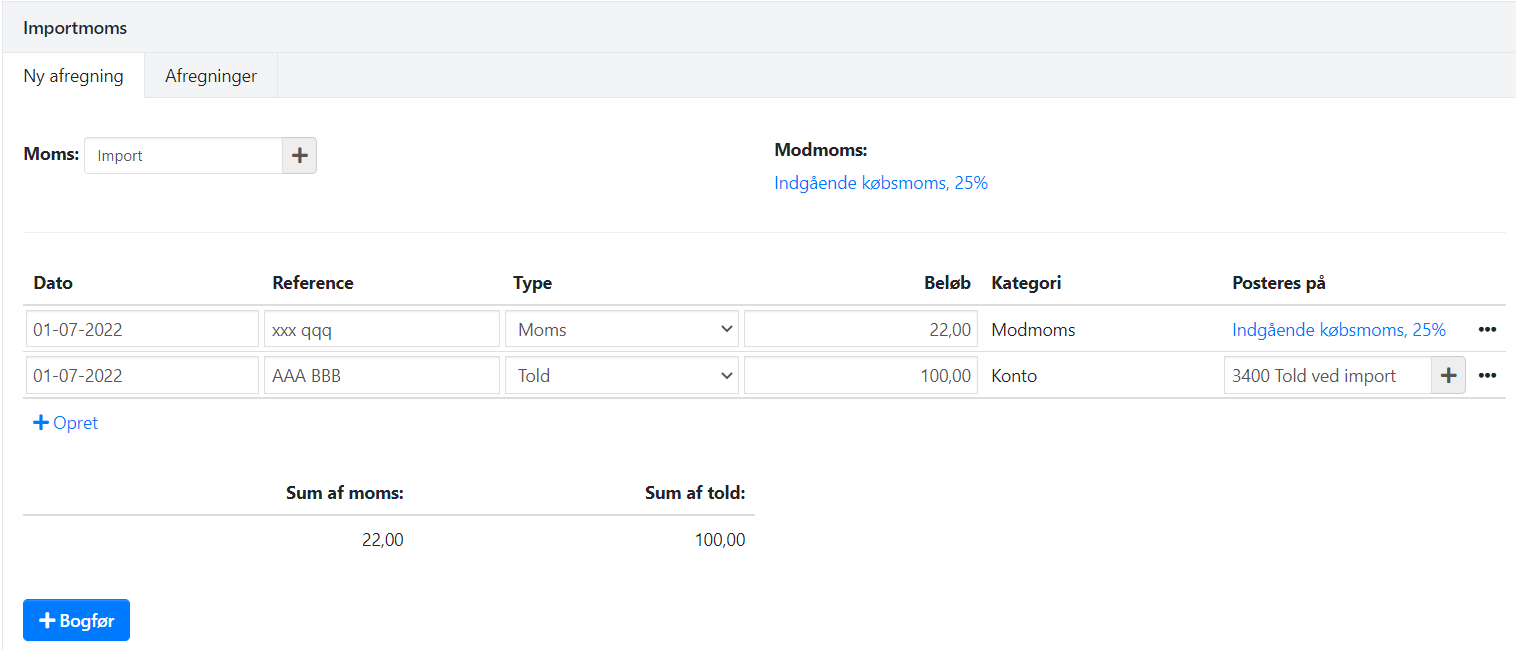

- Go to the menu Ledger> VAT > Import VAT statement and select the tab New Settlement

- Choose your Import VAT tax code at the top.

- Create a journal entry with date, reference, type = VAT, and amount.

- If customs duty is also added to the import specification from the Customs Authority (SKAT), then create an additional line.

- Enter the date, reference, type = Customs, amount, category, and ledger account on which the duty should be recorded.

Once the journal entries are entered, click on the 'Bookkeep' button.

Select the account from which any customs duty should be settled and choose the date of the payment. You must always select a payment account, but it will only be recorded if you have created lines with the type 'Customs' in the settlement.

Recorded settlements can be found on the 'Vat transactions' tab.

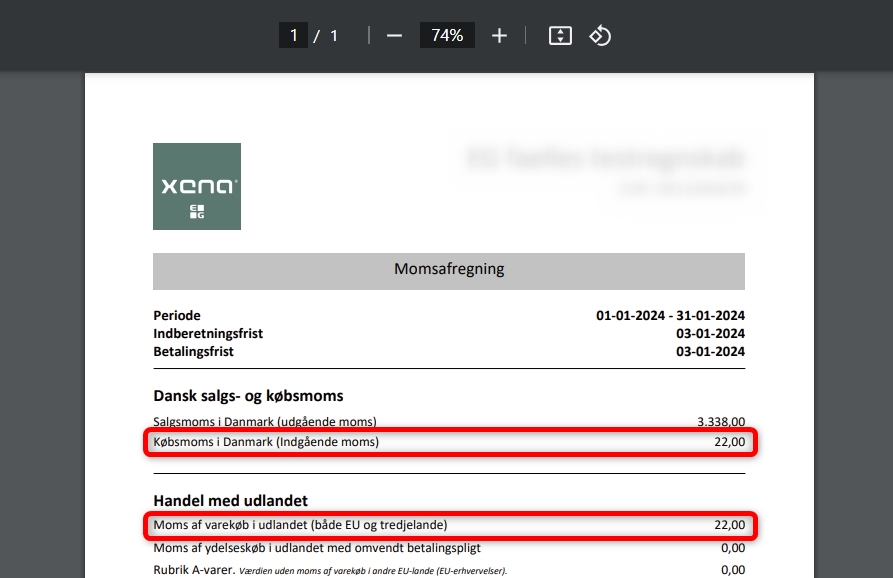

During a subsequent VAT settlement, the amounts will be allocated as follows if you have used standard input VAT as your contra tag account for the import VAT:

- Updated