VAT free sale

Sometimes there is a need to sell or purchase goods or services without calculating VAT. Learn more about how to do it in Xena.

Normally, VAT is applicable on all sales. However, there are exceptions for invoices to registered companies abroad and certain goods that are not subject to VAT. You can find a list of these goods at SKAT (Danish tax authorities).

VAT Determined by the article group

VAT is determined by the article group in Xena, which determines the applicable VAT rate. Xena automatically calculates VAT based on the article group and the country of the customer/supplier.

If an article is sold in Denmark, VAT will normally be applied, but if it is sold to a company abroad, VAT will not be applied. This works automatically in Xena, without the need for you to manually adjust/create VAT codes.

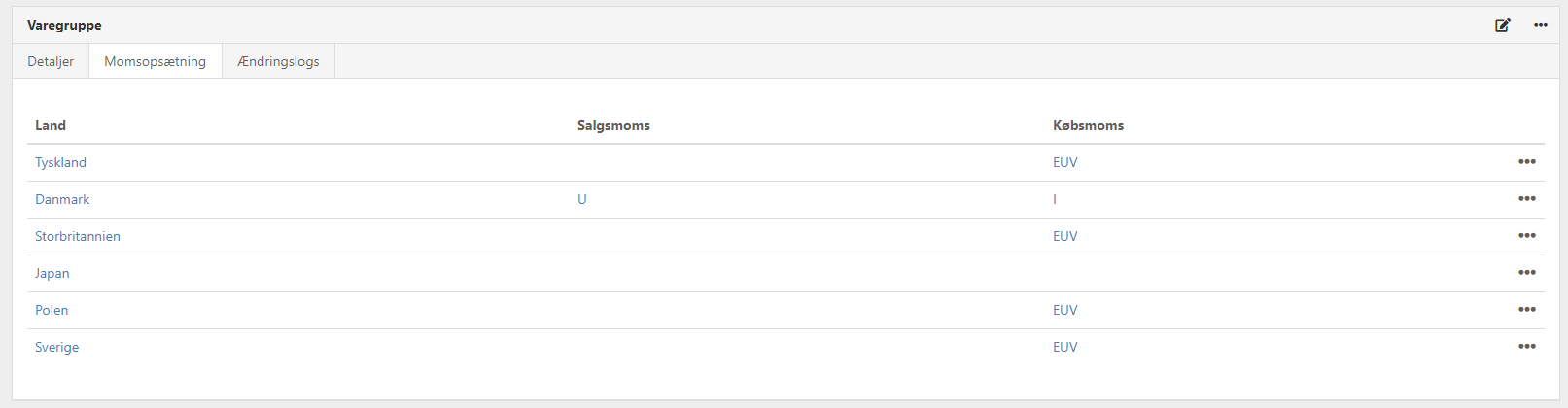

Each article group has VAT settings for each country where you sell/buy articles.

- Start by creating the article groups you need.

- Then, create at least one partner (customer or supplier) in the countries you trade with

- Every time you create a partner in a new country, the VAT settings are automatically expanded per article group.

An article group will look like the example below if you trade with multiple countries. When selling or buying articles belonging to this article group, the system will calculate VAT based on the VAT settings for the specific country.

Create VAT free article group and article

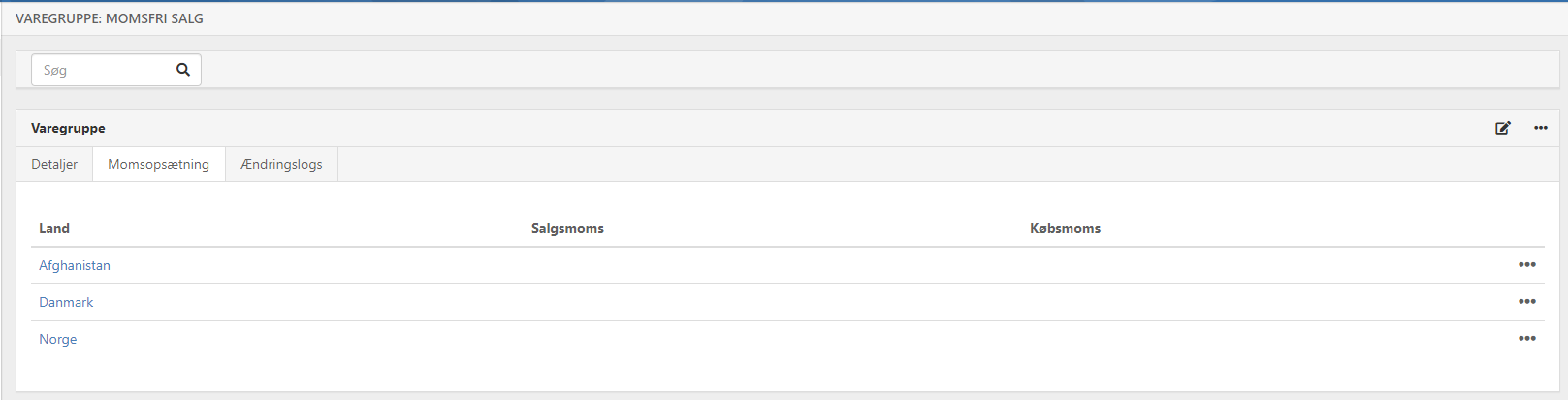

If you want to invoice an article without VAT, you can create a specific article group for this purpose, leaving the VAT codes for sales VAT and purchase VAT empty for Denmark in this group..

Go to the menu Setup > Article Setup, and select the tab 'Article groups.'

- Click on the 'Create' button and fill in the description for the group.

- On the created group, select the 'VAT Setup' tab.

- Next to Denmark, choose the option 'Edit' from the menu (the 3 dots).

- Select VAT code 'None' for both Sales VAT and Purchase VAT

- Click 'Create.'

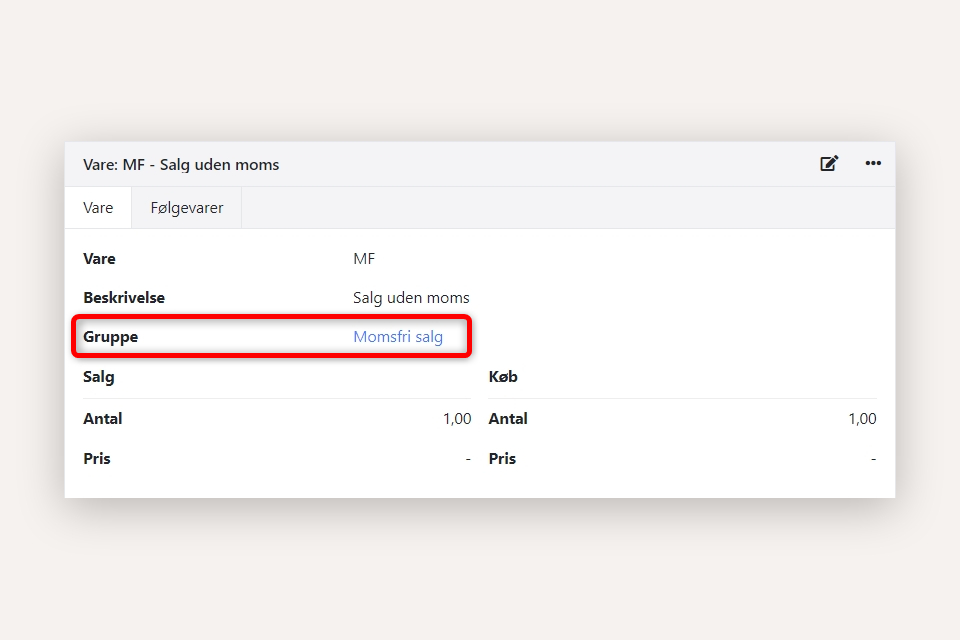

You can select this article group for the order lines where you want to sell/buy articles without VAT.

You can also create an article and assign it to the VAT free article group. When you use this article on an order line, Xena will not calculate VAT on the amount.

- Go to the menu Sales/Purchase > Article > Create article.

- Enter a description and REMEMBER to select the VAT free article group you just created.

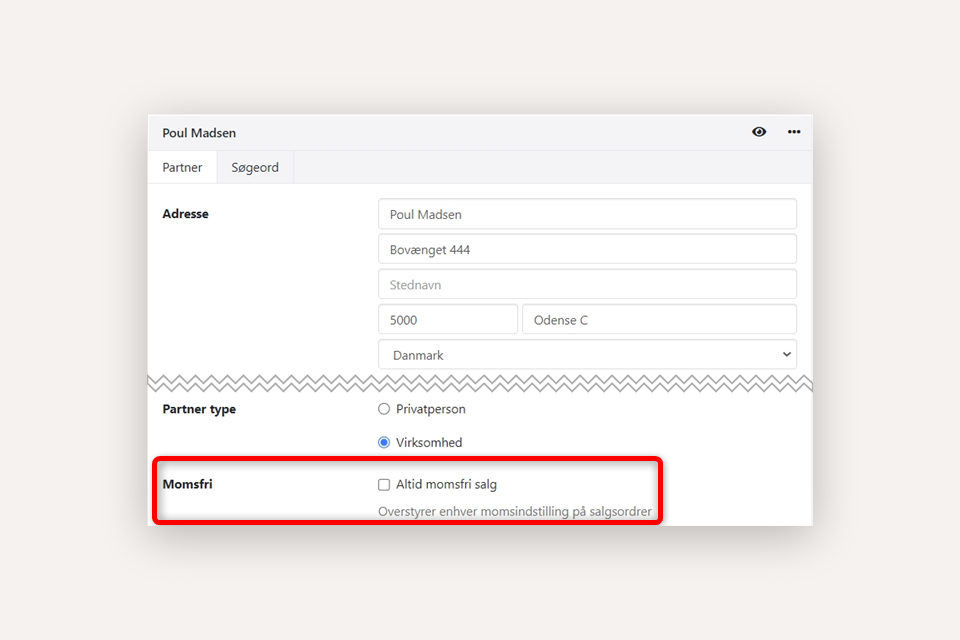

Override VAT on a Partner

If you always need to sell VAT-exempt to a specific customer, you can override the VAT setting for the partner. This means that all new orders for this partner will automatically be VAT-exempt.

You can find this setting on the partner in the box with name, address. Press the edit icon to access the field.

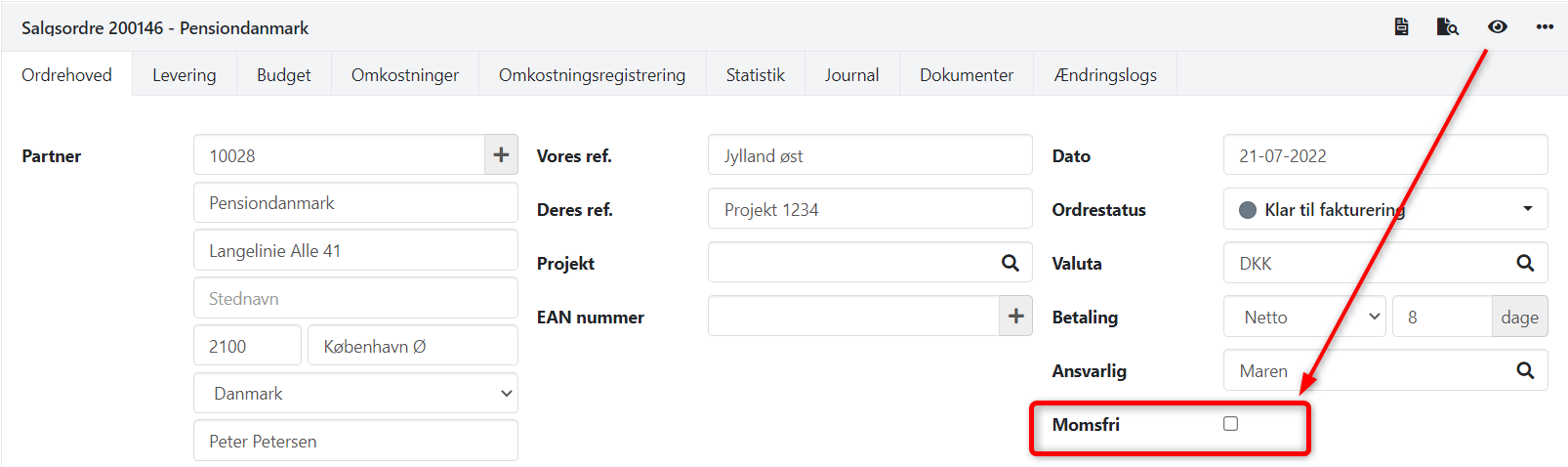

Override VAT on a Sales Order

On a sales order, you can also choose to make the entire sale VAT-exempt, regardless of which articles are sold.

If you have selected this setting on an order, the original VAT code will still be used on the order lines. The only change is that the VAT rate will be set to 0.00 on all invoice lines.

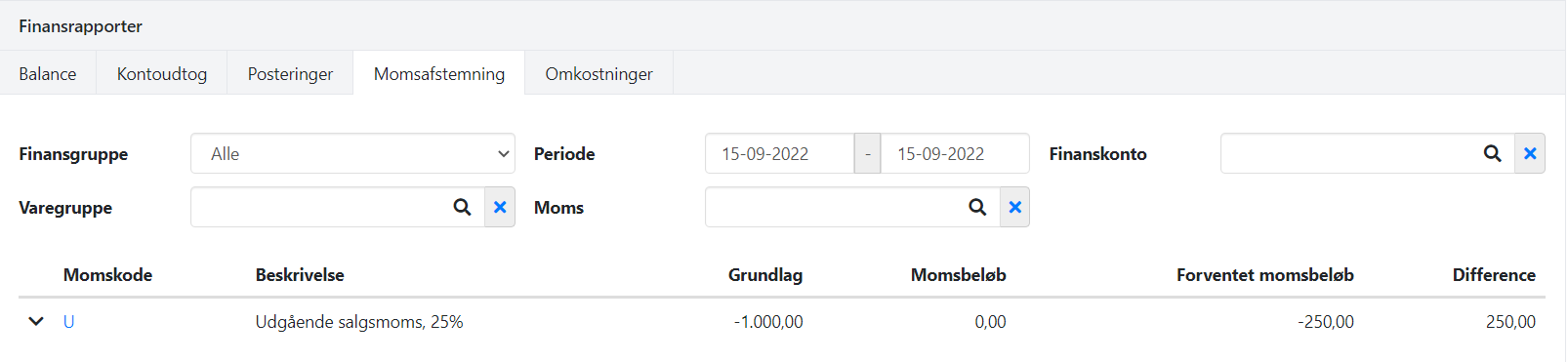

As you are thus overriding a standard VAT setup, it will be visible in the VAT Reconciliation report that you have a difference compared to the expected amount.

The basis amount for the income will still be included in section C on the Danish VAT settlement report, as for any other VAT-exempt sales.

For Norwegian fiscals, the incomes basic amount is reported on the VAT code that corresponds to the selected article group/country combination. If you want the sale to be reported on a different VAT code, you still need to manually adjust the VAT settings for the article group.

- Updated