VAT and VAT Settlement

What is VAT, and how is it settled in Xena?

Explanation of Terms

VAT, or Value Added Tax, is an indirect tax imposed on the price of goods and services when sold to consumers. Consumers pay VAT, but businesses collect it and then settle it with the tax authorities.

VAT-registered businesses have the right to deduct the VAT they pay on goods and services purchased for their company (input VAT) from the VAT they charge to their customers (output VAT). This is called VAT deduction, and it ensures that VAT is only paid on the value added by the business.

It is essential for companies to understand and comply with Danish VAT regulations to avoid possible fines or penalties. For accurate guidance on VAT rules and reporting requirements, it is best to consult an accountant or contact the Tax Authority directly.

VAT Reconciliation

Before VAT settlement is made, you cando a VAT reconciliation to check if the posted VAT amount matches the expected VAT amount. If there are discrepancies, you can investigate the reason.

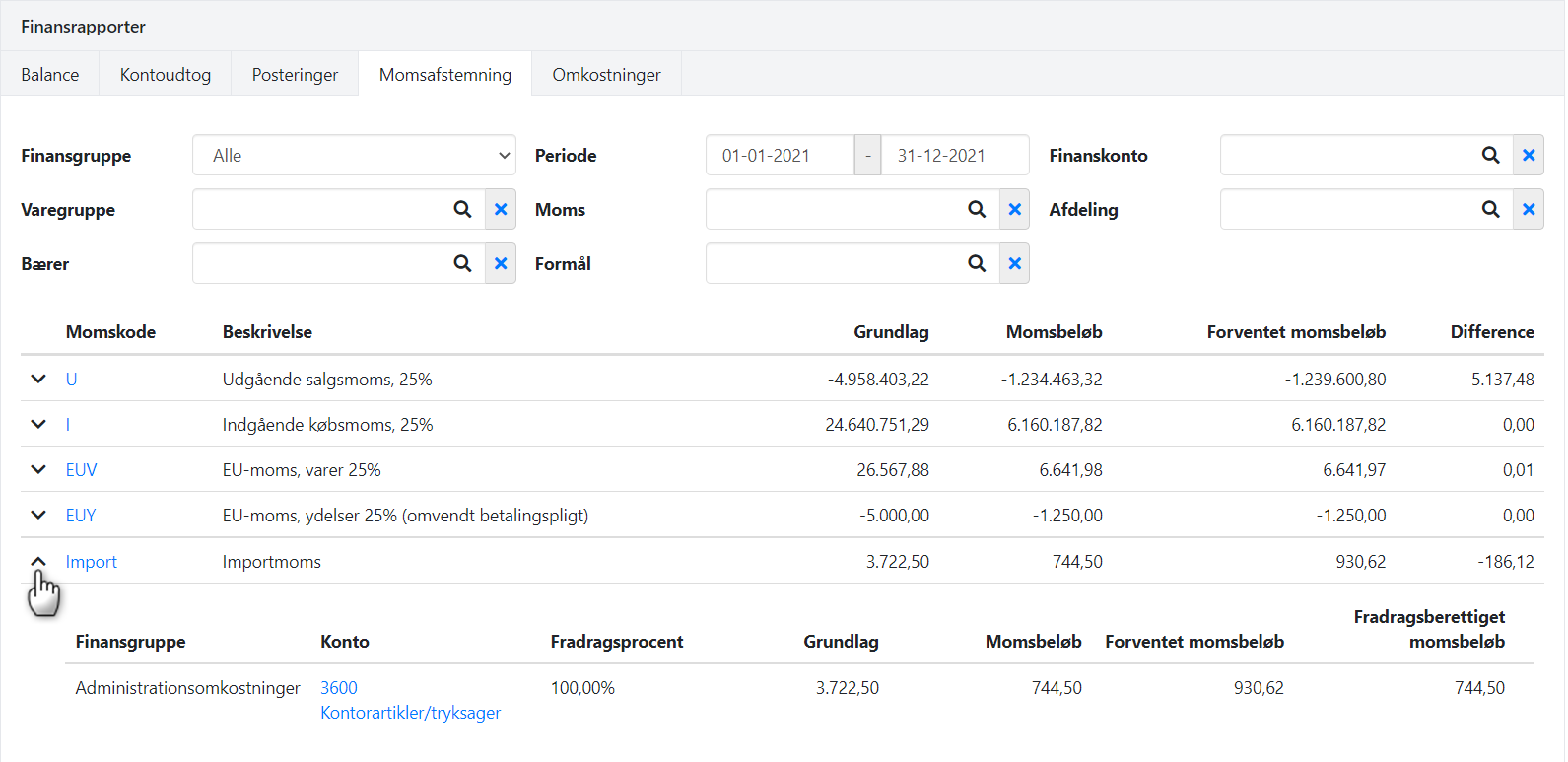

VAT Reconciliation via Ledger Report

- Navigate to Ledger > Ledger Reports, select the tab 'VAT Reconciliation'

- Enter period

- Expand the VAT codes to see the expected and posted VAT amounts for each ledger account

- If you print the report, you can view the expected and posted VAT amounts and any differences for each account

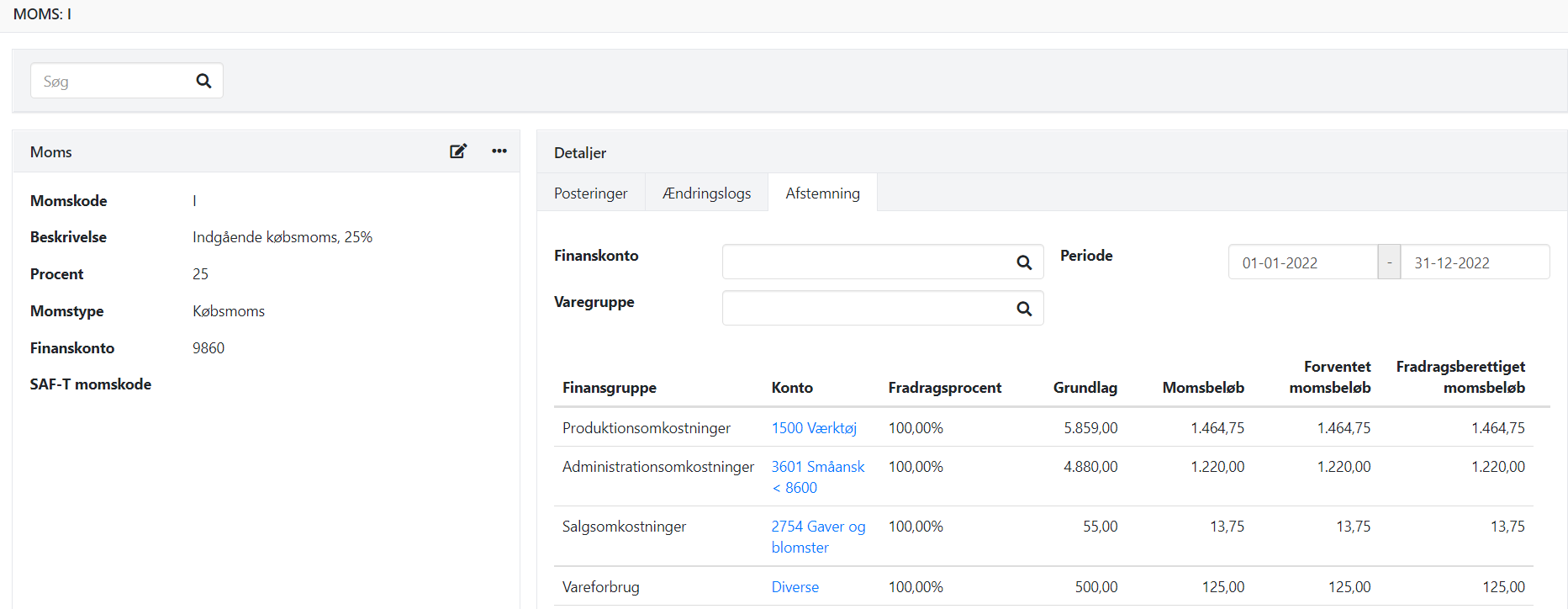

VAT Reconciliation via VAT Code

- Open the VAT code (click on the VAT code in the report)

- In the box on the right, choose the tab 'Reconciliation'

- Enter the desired period

- See the summary of VAT amounts for the associated ledger accounts

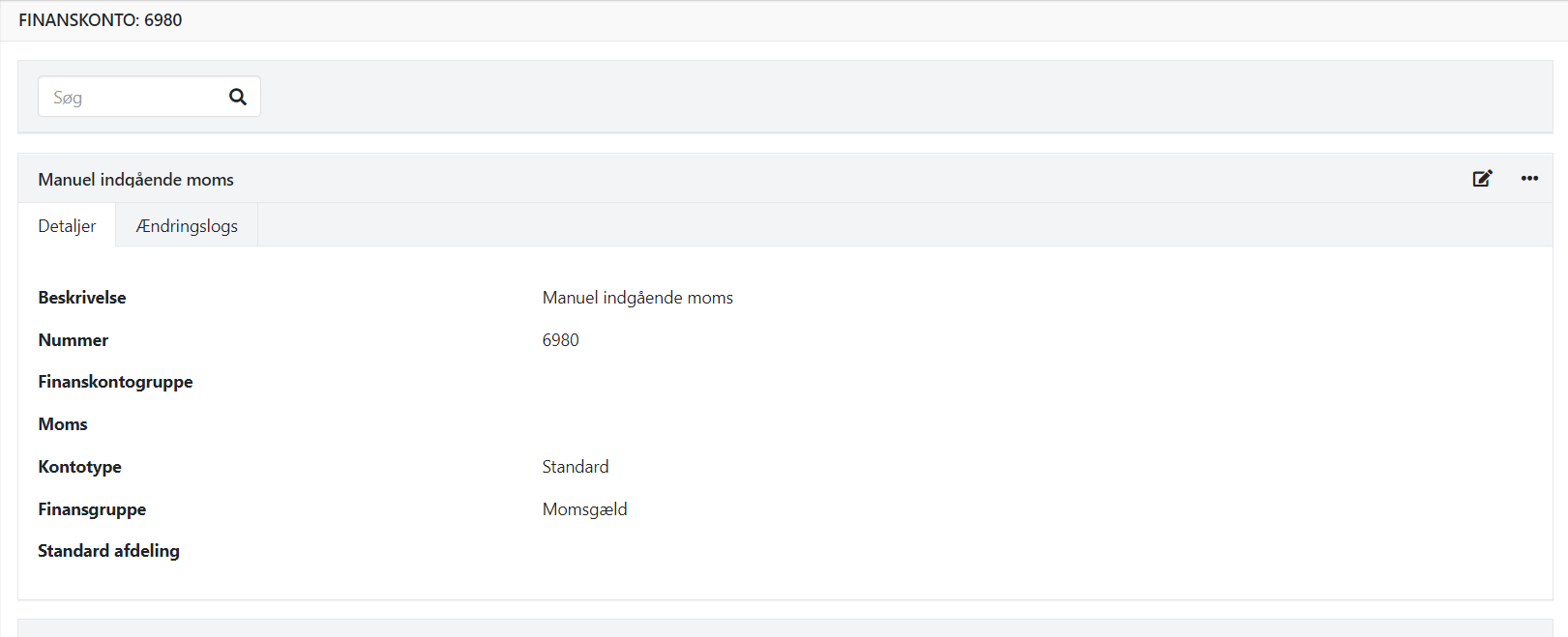

Create Ledger Account for Manual VAT

VAT codes and VAT rates are not fixed in Xena. You can add and modify VAT codes as needed. If you wish to post manual VAT, you must create ledger accounts specifically for this purpose.

- Open the Chart of Accounts via Ledger > Account overview

- At the top, choose 'Liabilities' and expand the group 'VAT payable'

- Click on 'Create'

- Fill in the account number/description. It's essential not to fill in any VAT code for the account

You can now select this account in the ledger entry when you want to post a manual VAT amount.

Settle VAT

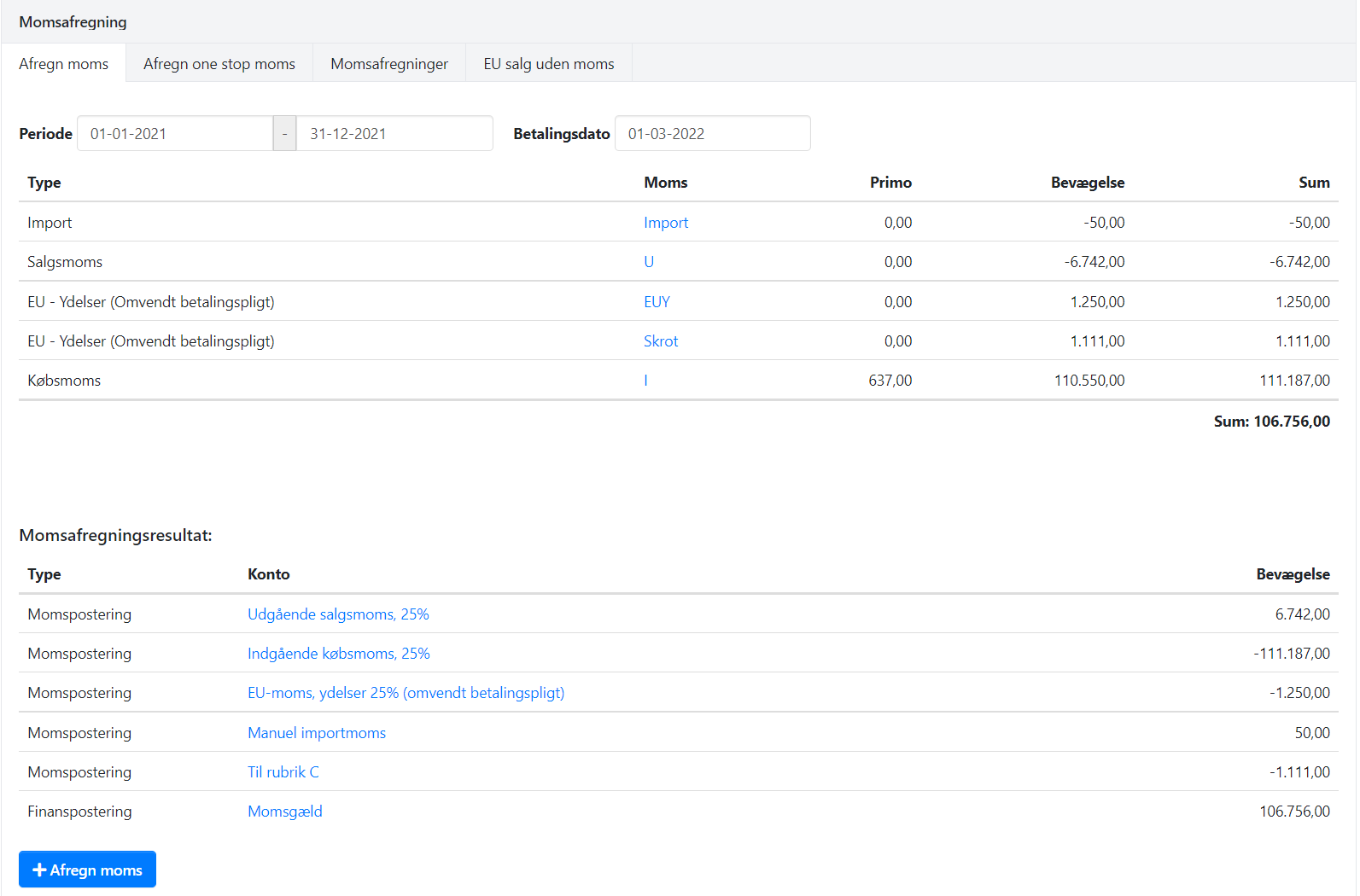

VAT settlement is made in the menu Ledger > VAT > VAT Settlement, select the tab 'Settle VAT'.

Note: It's a good idea to re-calculate the primo postings before making the VAT settlement!

- Enter the period for which you need to settle VAT

- The payment date is just a suggestion, you can always edit it later

- Check the displayed VAT figures

- Click on 'Settle VAT' to create postings and print the report

The VAT settlement is posted as an entry per VAT code, and the total amount is posted to the account 'VAT payable.'

After VAT Settlement

- You must report the VAT figures for the period to the tax authorities

- Remember to lock the period after VAT settlement to avoid further VAT postings in the period.

- If you cancel a previous VAT settlement, reopen the period.

Read more: Settle VAT

Read more: Fiscal periods

Reprint or Cancel VAT Settlement

You can find all previous VAT settlements on the posted voucher:

- Go to Ledger > VAT > VAT Settlement

- Select the tab 'VAT Settlements'

- Here, you can reprint or cancel the VAT settlement

- You must always cancel settlements in chronological order, canceling the newest one first

If you wish to print a 'List Report,' showing the VAT-free sales to other companies within the EU, you can find it on the tab 'EU sales without VAT'.

Pay VAT Settlement

When the VAT payment is due, either by making a payment to the tax authorities or when they have deposited money into your account, you can find the settlement in Ledger > VAT > VAT Settlement, select the tab 'VAT Settlements'.

- Click on 'Pay settlement' for the relevant settlement.

- Enter the actual payment date and the payment account from which the VAT is paid.

- Click on 'Settle VAT' to create the posting on your payment account.

- The contra tag for the payment is the account 'VAT payable,' which will be reset on the payment date.

- Updated