VAT One Stop Shop

From July 1, 2021, the VAT rules for sales to individuals in the EU have been changed. This means that One-Stop VAT has been replaced by the VAT One-Stop Shop (MOSS).

On July 1, 2021, the VAT rules for sales to private individuals in the EU were changed. One of the changes is the introduction of a new common EU threshold of 10,000 euros per year. The threshold includes a company's total sales to other EU countries in addition to sales in its own home country. The new threshold for the entire EU is significantly lower than the previous thresholds, which only apply to a single country.

The threshold means that EU businesses must pay VAT in the consumer's country when the company's total distance sales of goods and sales of electronic services, including telecommunications services and broadcasting services, to all other EU countries exceed 10,000 euros per year.

With the VAT One-Stop Shop, you can register your company for sales to private individuals in the EU in one EU country. Under this scheme, you only need to report and pay VAT for your sales to the entire EU in one place, instead of in each individual country.

Xena does not support the new scheme as only a few of our users are affected by the new rules.

Read more about the new rules at Skat.dk (website of the Danish Tax Authority).

Here's how you can use the VAT One-Stop Shop in Xena:

As a seller, you need to apply the VAT rate according to the VAT rules in the buyer's country. It is important to be aware of the VAT rate to be applied on the invoice you send to your customer. Start by creating a VAT code for each country:

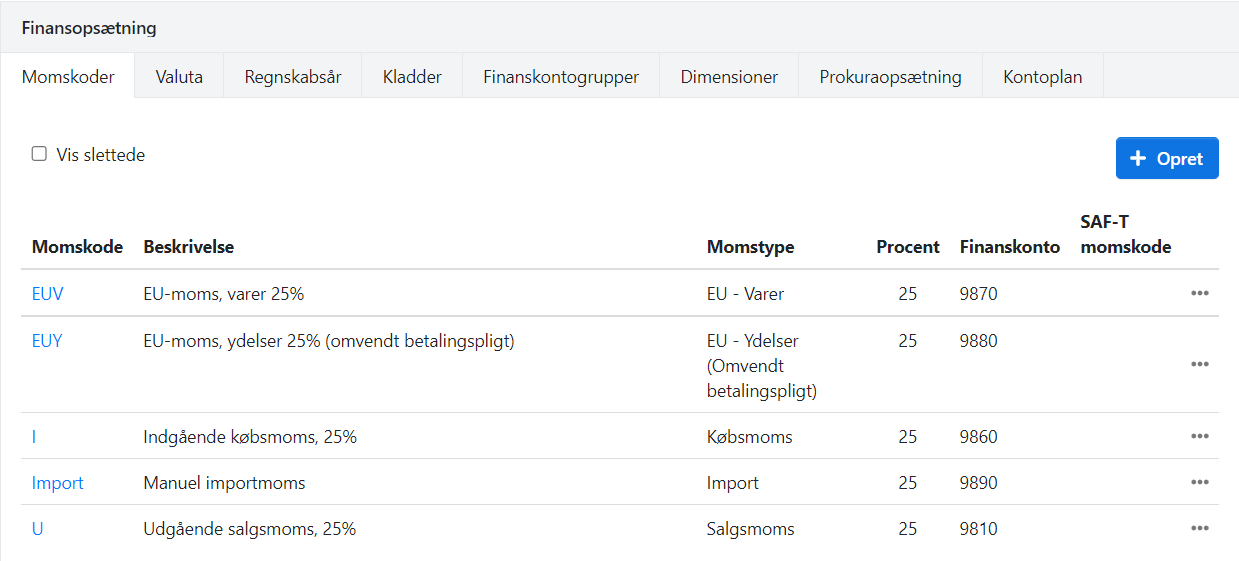

- Go to Setup > Ledger Setup and select the 'VATs' tab.

- Create a VAT code for each country you sell to in the EU.

- Set the VAT rate according to the country's applicable rules.

- The VAT type should be Sales.

Next, create or adjust the item groups that contain goods you sell to other EU countries.

- Go to Setup > Article Setup and select the article group first and then the 'VATs' tab.

- Here, you will see the countries where you currently have a partner registered.

- Click on the country to edit the VAT setup.

- In the 'Sales VAT' field, select the VAT code you just created for this country.

- Perform these steps for each article group from which you sell goods to private individuals in the EU.

If you have partners where VAT should not be charged on the invoice, you can directly select this option for the partner.

When you prepare a VAT settlement, the basis and VAT amount will be displayed for each VAT code, which can then be reported to the tax authorities.

- Updated