Chart of Accounts

Learn more about how the fiscal chart of accounts is created and utilized in Xena.

In Xena, you can post and invoice without having to create the entire chart of accounts beforehand. The chart of accounts is formed gradually as you use the system.

What makes Xena's Chart of Accounts Different

Xena's chart of accounts is largely generated automatically based on the article groups and VAT codes you create.

Xena automatically manages the bookkeeping of revenue, purchases, stock transactions, tax declarations, customer ledger account, vendor ledger account, and equity, accurately placing them within the main groups of the accounts. Each transaction refers to its origin, progressively building the chart of accounts from the created entries.

The only thing you need to manually create is the ledger accounts on which you will be posting. This can be done by:

- Selecting from the default chart of accounts available in Xena

- Continuously creating new accounts during posting

- Importing your previous chart of accounts through the archive. Read more in the guide Here

Accounts for Sales/Purchases/stock

When you create a ledger account in the Sales or Purchases group, you are actually creating an article group. The new article group will also automatically appear under assets in the stock group. This way, there is an automatic link between stock, purchases, and sales.

If you need to manually record stock, create accounts for it under Assets in the 'Manual stock' main group. Accounts in the 'stock' main group can only be recorded via article numbers where stock management is enabled.

Accounts for VAT

When creating a new tax account, you must choose whether it is for the automatic bookkeeping of taxes or manual tax posting. More information on creating tax codes can be found in the guide here.

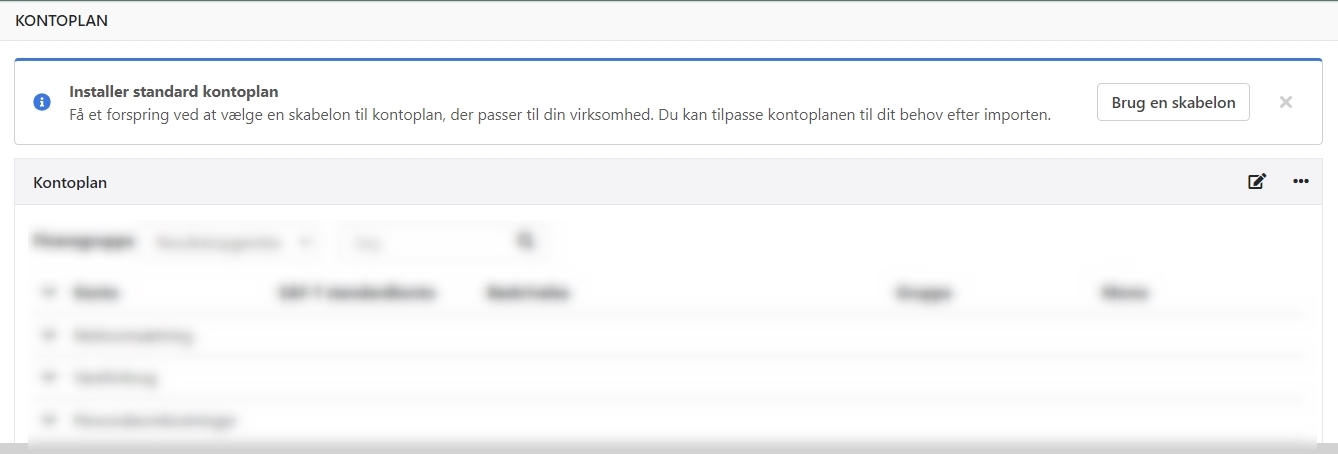

Standard Chart of Accounts in Xena

After creating a new fiscal, you have the option to import a default chart of accounts to get started more quickly.

The first time you go to Ledger > Account overview > Account overview, you will see the following information at the top of the view.

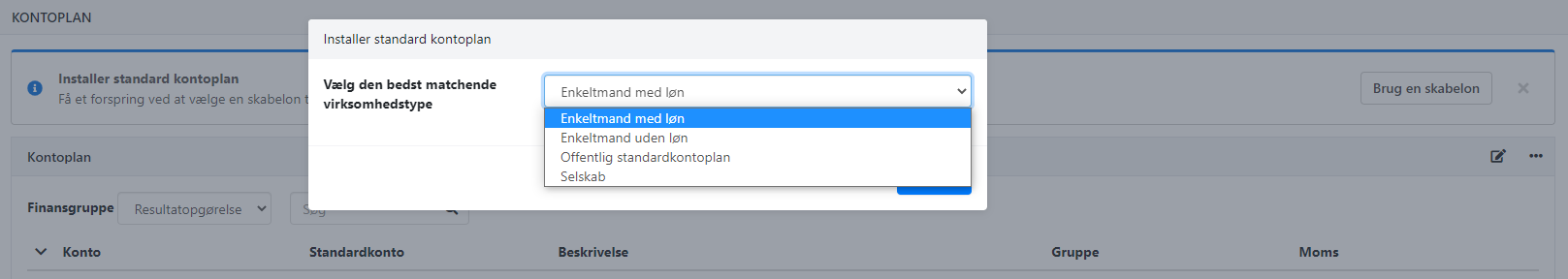

- Click on the 'Use a template' button

- Choose the chart of accounts that best matches your company type

- Click 'Install'

Note: Review the imported chart of accounts to ensure that tax codes have been added to the relevant accounts where tax is deducted.

Public Standard Chart of Accounts

If you choose to install the public standard chart of accounts, you need to rename the account numbers for the following accounts you want to use:

Income:

- System difference = 2720

- Financial articles = 3490

- Exchange rate difference = 3610

Assets:

- Customer receivables = 6190

- Liquid funds:

- Cash = 6470

- Bank = 6480

Liabilities:

- Equity = 6510

- Supplier payables = 7440

Tax liabilities:

- Outgoing sales tax, 25% = 7680

- Incoming purchase tax, 25% = 7740

- EU sales tax, goods 25% = 7700

- EU sales tax, services 25% (reverse charge) = 7720

- Manual import tax = 7701

- Oil and bottled gas tax = 7760

- Electricity tax = 7780

- Natural gas and town gas tax = 7800

- Water tax = 7820

- Tax liabilities = 7840

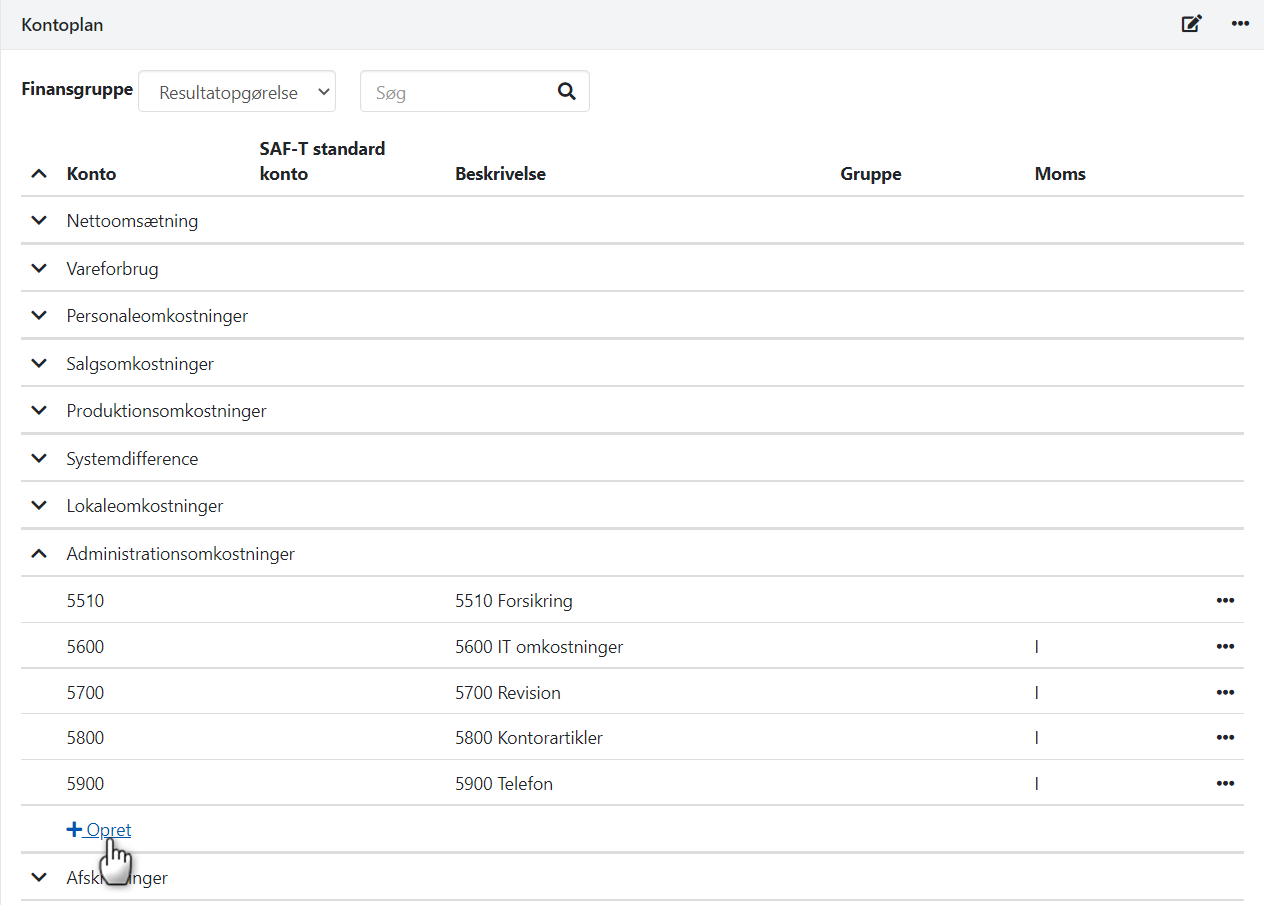

Creation of Ledger Tag

To create or edit accounts, go to Ledger > Account overview > Account overview.

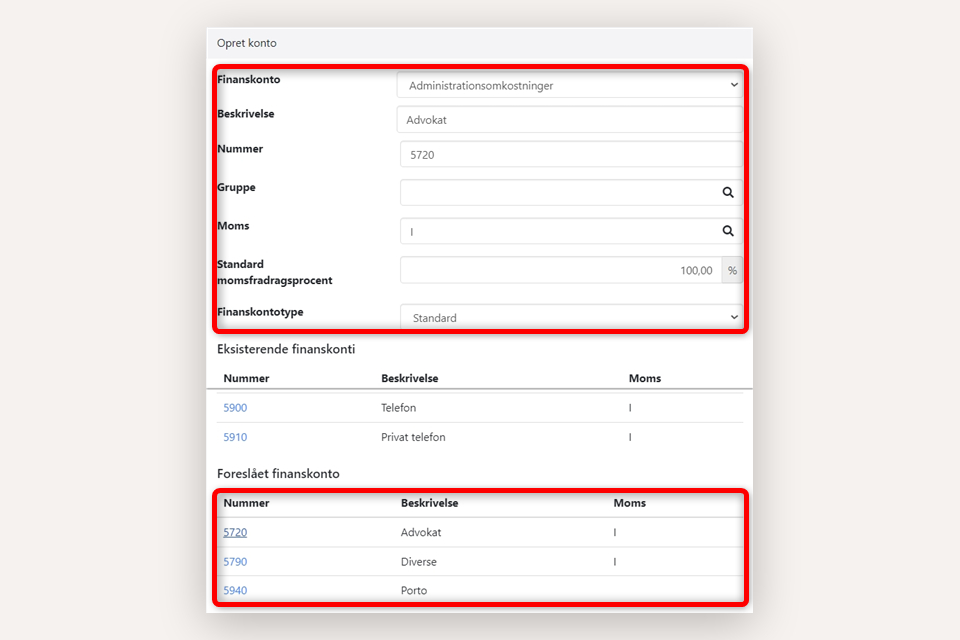

- To create a new account, click 'Create'

- To edit an existing account, click the menu icon (three dots) next to the account and select 'Go to ledger account'.

Description, number, and similar details can be entered manually, or you can choose a suggestion at the bottom of the dialog under 'Proposed ledger accounts'. Regardless of the method, all fields can be modified:

Group: Used for sub-categorizing main groups (see description further down in the guide).

Tax: Select a default tax code. This can be overridden during posting.

Default deduction percentage: Usually set at 100%, providing full tax deduction during posting on the account.

Ledger tag type: 'Standard' is typically chosen.

- If you select 'Payment Account', you can use the account as a contra account in the cash entry and during voucher registration

- If you select 'Exchange Rate Difference', you can use the account as a differential account when posting payments and similar

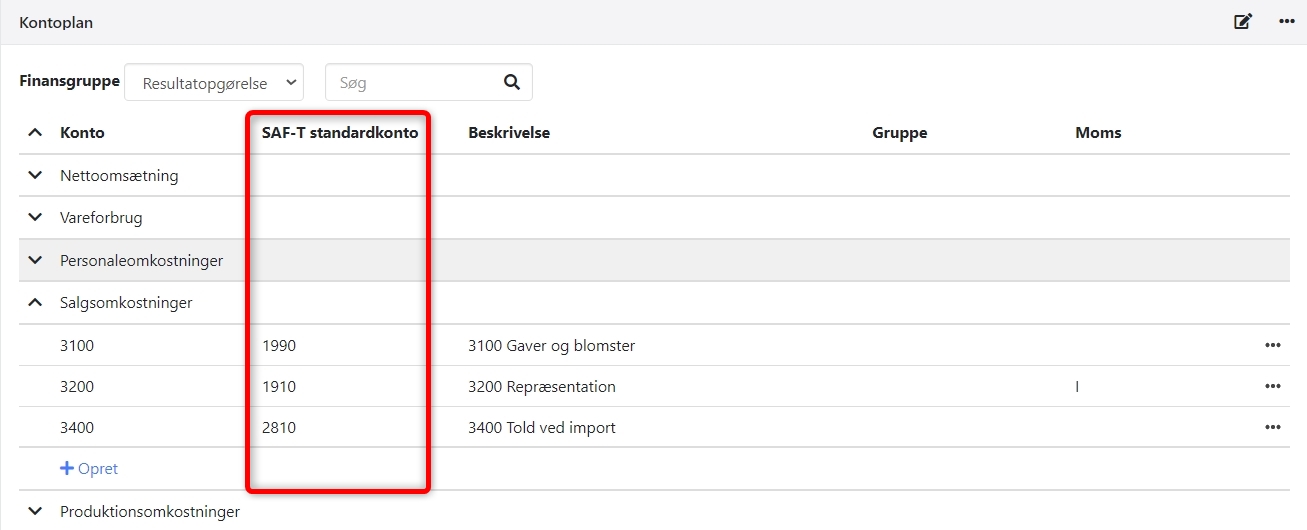

SAF-T Standard Account

This column is used to enter account numbers according to the public standard chart of accounts. According to the new Danish bookkeeping law, you must either:

- Rename your ledger account numbers in accordance with the public standard chart of accounts, or

- Enter additional ledger account numbers in the 'SAF-T Standard Account' column for all your ledger accounts.

Entering standard account numbers is necessary before you can report via Regnskab basis. Link to the guide for the Danish standard chart of accounts.

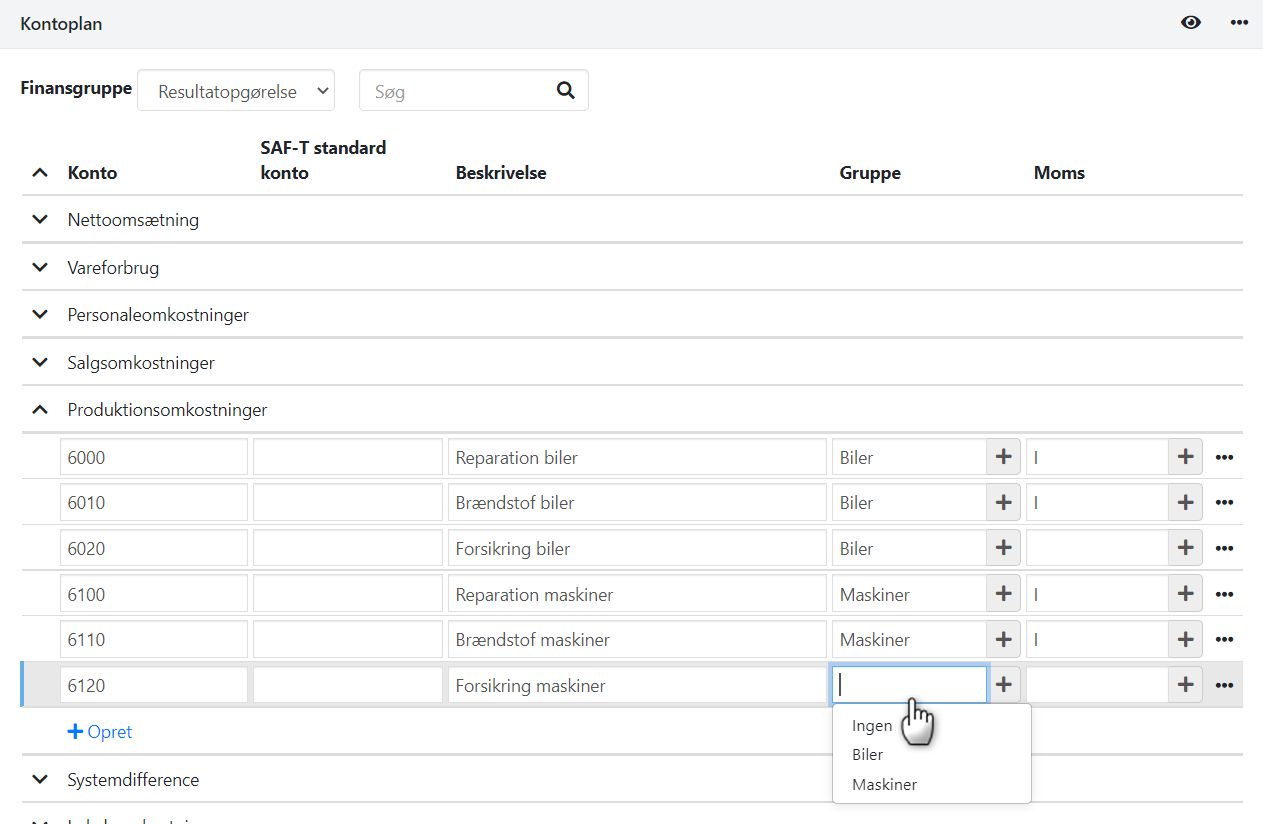

Subgroups

You can create 'Subgroups' in the chart of accounts to further divide the accounts within each Main Group. When printing a balance sheet, subtotals will be displayed for each subgroup.

You can create the subgroups directly from the account overview or create them in the menu Setup > Ledger setup, select the tab 'Ledger account groups'.

In this example, my ledger accounts in the Production Costs main group have been assigned groups. When printing a balance sheet, two additional subtotals will be displayed: 'Total Vehicles' and 'Total Machinery'.

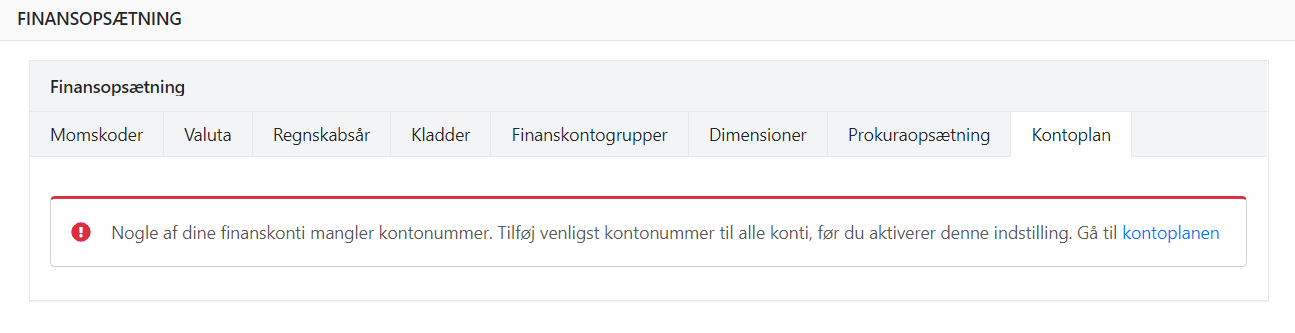

Mandatory account numbers

If you wish to ensure that all financial accounts MUST have an account number upon creation, you can activate the account number requirement via Setup > Ledger Setup > Account plan.

If you see a warning, it means you have already created some ledger accounts without account number.

Click the link to open the chart of accounts. Click the edit icon at the top right and review all groups for both the Income, Assets, and Liabilities. Then activate the account number requirement when you are sure all accounts have account numbers.

Prints/Downloads

At the bottom of the chart of accounts, you have the option to download the chart of accounts to a CSV file.

Printing the Statement, Assets, and Liabilities can be found via the menu Ledger > Ledger Reports.

Read more: Setup of dimensions.

- Updated