VAT and VAT Settlement

What is VAT, and how is it managed in Xena?

What is VAT?

VAT (Value Added Tax) is an indirect tax applied to goods and services when sold to consumers. Although the tax is paid by consumers, businesses are responsible for collecting it and reporting it to the local Tax Agency.

VAT-registered companies can deduct the VAT they pay on purchases for the business (input VAT) from the VAT they collect from their customers (output VAT). This is called VAT deduction and ensures that VAT is only paid on the company’s actual value creation.

To avoid fines or penalties, it is important to comply with current VAT regulations. For specific guidance, consult an accountant or contact the local Tax Agency.

VAT Reconciliation

Before settling VAT, you should perform a VAT reconciliation to ensure that the recorded amounts match the expected figures. Any discrepancies should be investigated.

➡️ Read how to verify VAT settlement amounts.

Via Ledger report

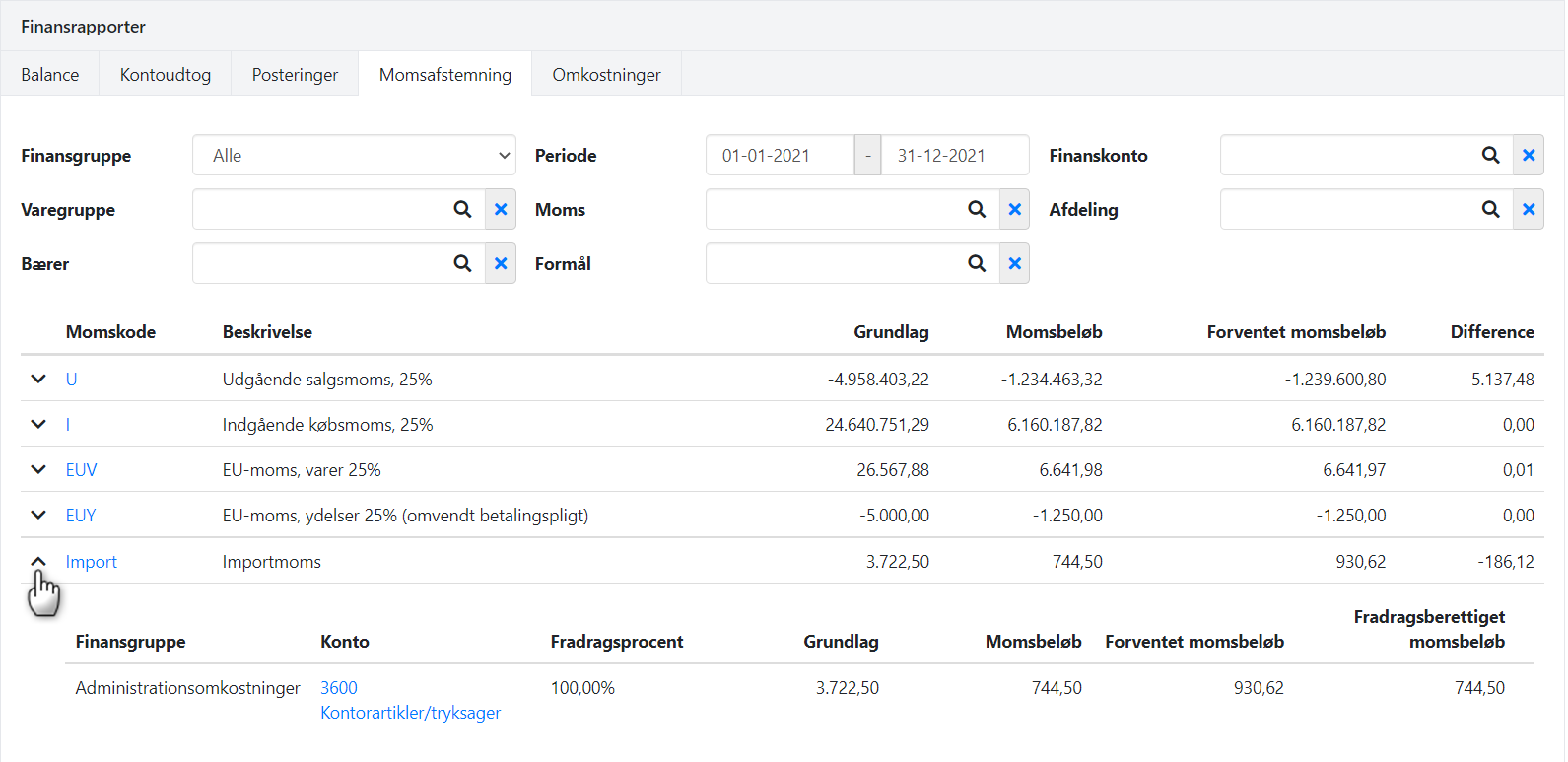

- Go to Ledger > Ledger reports, and select the VAT Reconciliation tab.

- Enter the desired period.

- Expand the VAT codes to view expected vs. posted VAT amounts per account.

- Print the report for a detailed overview of amounts and differences.

Via VAT Code

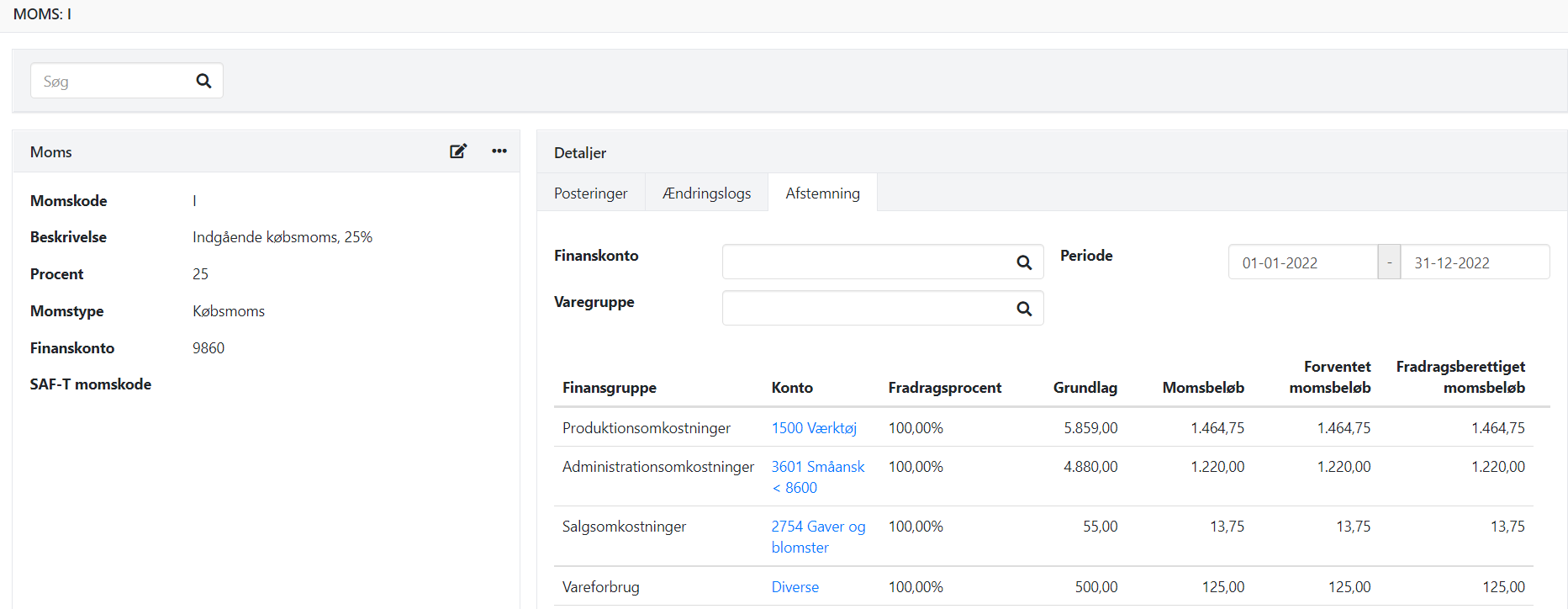

- Open a VAT code by clicking it in the report.

- Select the Reconciliation tab.

- Enter the period.

- View a summary of VAT amounts per account.

Create account for Manual VAT

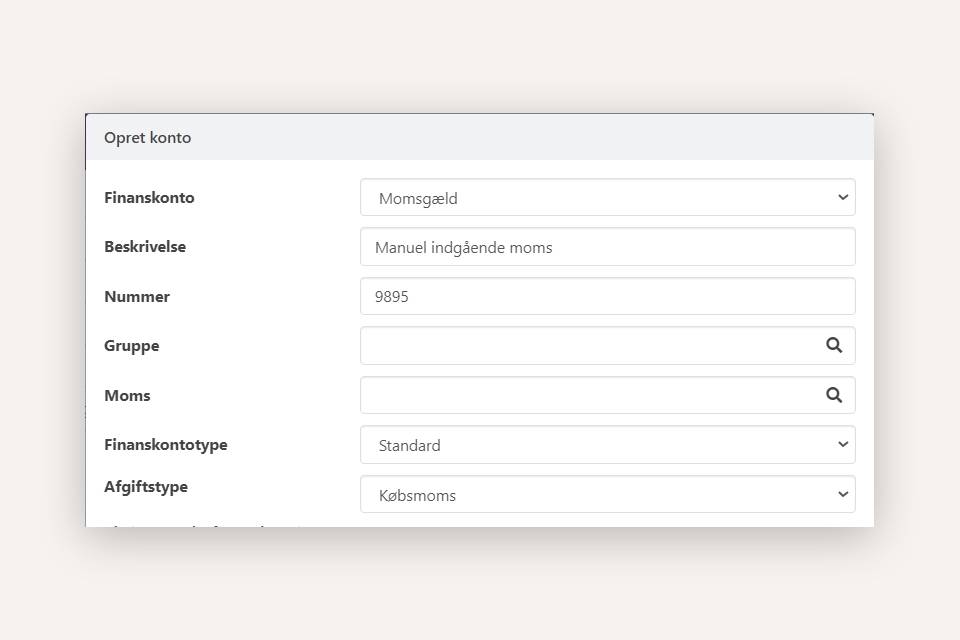

In Xena, VAT codes and rates are flexible and can be modified. If you need to post VAT manually, create a dedicated account first:

- Go to Ledger > Accounts overview > Account overview.

- Select Liabilities and expand the group VAT payable

- Click Create.

- Enter account number and description (leave the VAT code field blank).

- Select a relevant Tax Type.

- The account can now be used in the journal for manual VAT postings.

Post VAT Settlement

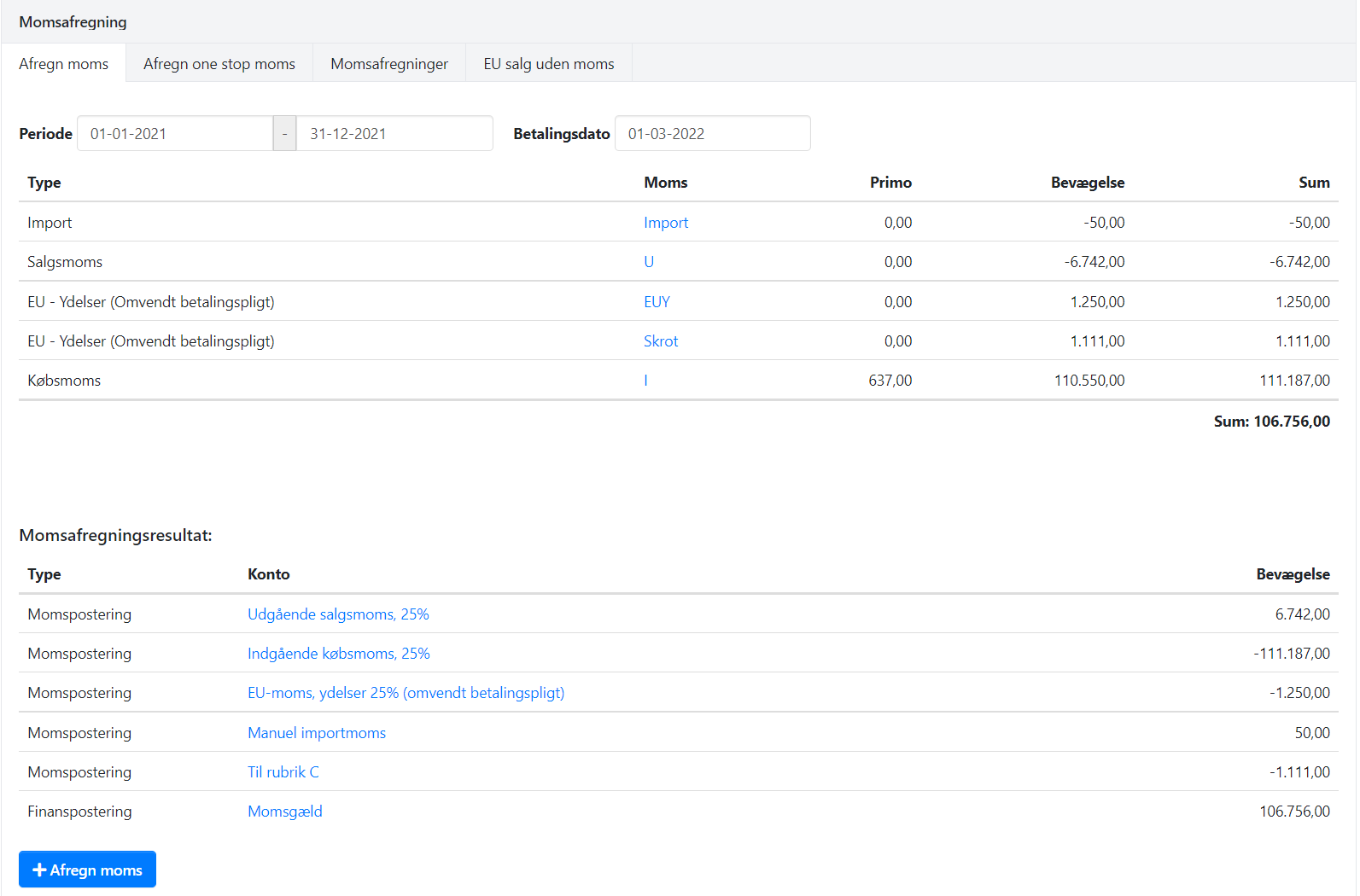

- Go to Ledger > VAT > VAT Settlement, and select the Settle VAT tab.

- Enter the settlement period.

- Check the payment date (can be edited later).

- Verify the VAT figures.

- Click Settle VAT to generate entries and print the report.

⚠️ Note: Always recalculate opening balances before settling VAT!

The system posts VAT settlements per VAT code, while the total sum is posted to VAT Payable.

After VAT Settlement

- Remember to lock the period after VAT settlement to avoid further VAT postings in the period.

- If you cancel a previous VAT settlement, reopen the period.

➡️ Read more about Fiscal periods

Reprint or Cancel a Settlement

- Go to Ledger > VAT > VAT Settlement

- Select the VAT Settlements tab.

- Here you can reprint or cancel a settlement.

⚠️ Note: Settlements must be cancelled in chronological order (latest first).

The EU sales listing for VAT-free sales is found under the EU Sales without VAT tab.

Pay VAT Settlement

When VAT is due, either because you pay SKAT or SKAT refunds you, record the payment:

- Go to Ledger > VAT > VAT Settlementt, and select the VAT Settlements tab.

- Click Pay Settlement for the relevant entry.

- Enter payment date and payment account.

- Click Settle VAT to post the payment.

The payment is automatically offset against VAT Payable, which is cleared on the payment date.

- Updated