Ready for a new fiscal year

Your todo list to get ready for a new fiscal year in Xena.

Open a new fiscal year

Whether you are a new user or have been using Xena for some time, here are a few useful things to know about year-end closing or setting up a new company.

For new users, it's important that in the menu Ledger > Primo Postings, you verify that the start date for your first fiscal period is as desired. If you want to change the start date, this MUST be done before creating the first invoice or posting the first entry.

Fiscal Periods

When setting up a new fiscal year, a fiscal period is created with a start date of 01.xx.xx and an end date of 31.xx.xx. The name of the fiscal period will typically be the year, e.g. '2022' or '2021-22'.

To be able to invoice and post entries in a new year, the fiscal period must be set up. The old fiscal year does not need to be closed. You can continue to invoice and post entries in all fiscal periods as long as they are not closed.

NOTE: If you have calculated Primo Postings or posted entries in a fiscal year, the start and end months CANNOT be changed afterwards, so be sure to set up your fiscal year correctly from the beginning.

- Go to the menu Ledger > Primo Postings.

- Press 'Create'

- Select the Start and End months in the dialog.

- It's possible to create fiscal years that don't follow the calendar year, and it's also possible to create years that are longer or shorter than 12 months.

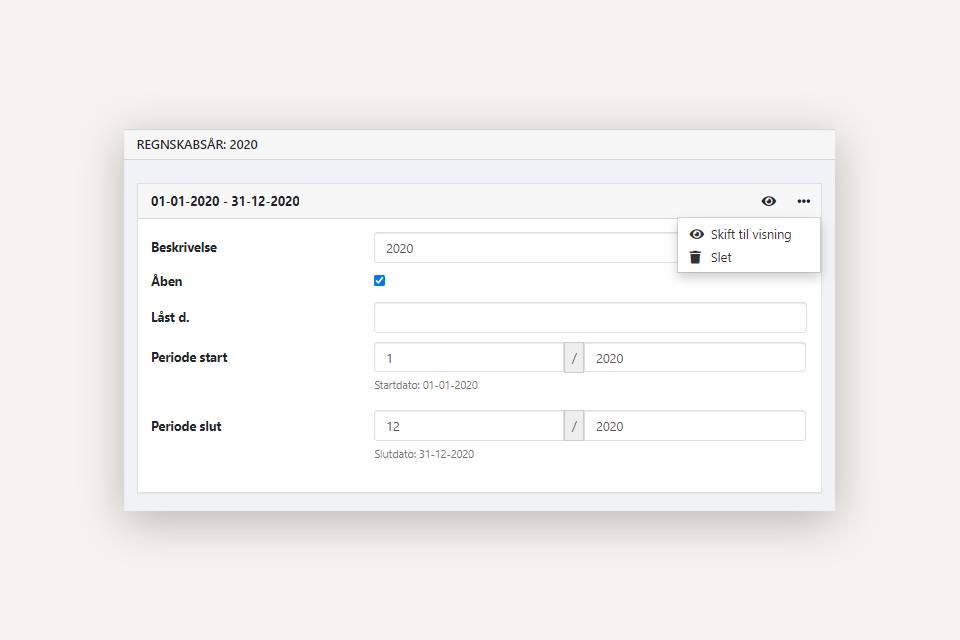

Periods can be edited after creation by opening the current fiscal year and pressing the edit icon at the top right. Now you can edit the description and start/end month.

In the same menu, there's also an option to delete the fiscal year.

Recalculate primo postings for the new Year

Once the new year is set up, the closing balances from the old year need to be transferred to the Primo Postings in the new year. This is done by recalculating the Primo Postings.

Select the new fiscal year via the menu Ledger > Primo Postings.

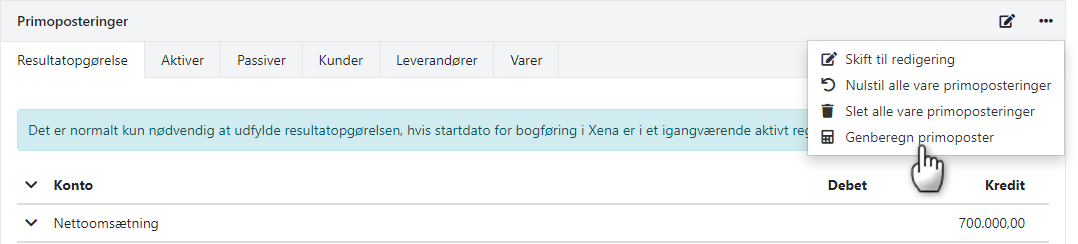

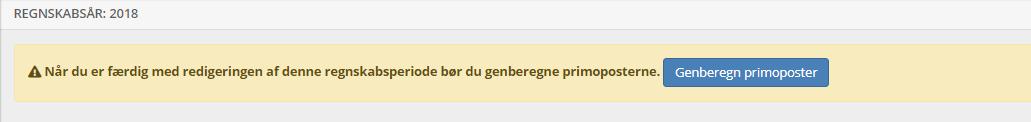

- There's likely a warning already displayed at the top of the screen indicating that recalculation is needed. Press the 'Recalculate Primo Postings' button here.

- If the warning doesn't appear, you can open the menu in the 'Primo Postings' box at the bottom of the screen and select 'Recalculate Primo Postings'.

NOTE: If you post entries in an old fiscal year, remember to recalculate the Primo Postings for the subsequent year. In this case, a warning will also automatically appear the next time you enter the ledger entry, for example. There will be a link to recalculate Primo Postings.

Locking or closing periods

Go to the menu Ledger > Primo Postings and select the fiscal year you want to lock or close.

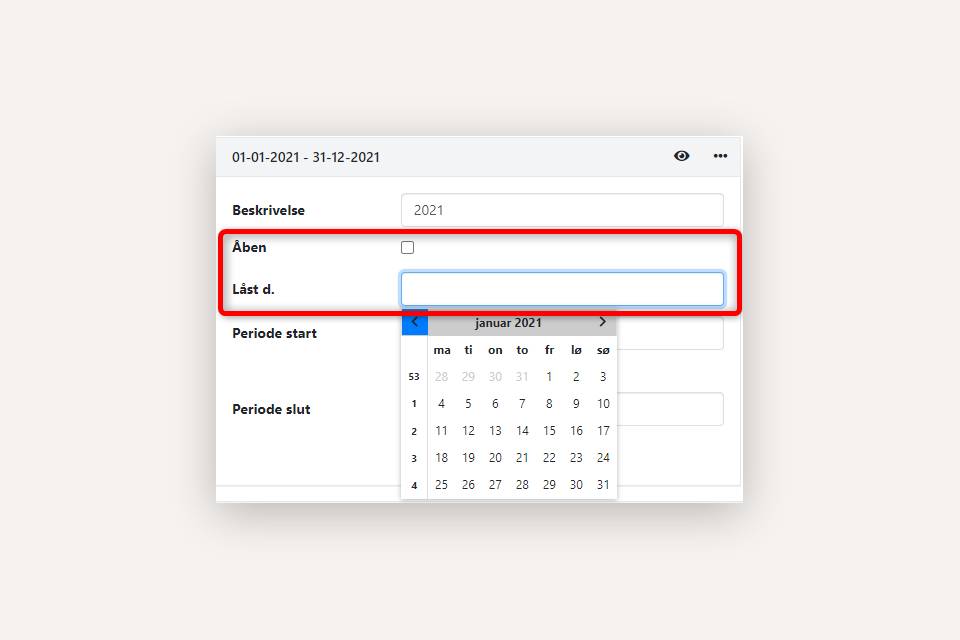

You can lock posting before a specific date by entering the date in the 'Locked at' field. After you've done a VAT reconciliation, for instance, it's a good idea to set the VAT reconciliation date as the locked date to avoid making additional VAT entries in the reconciled period.

If you want to completely lock the fiscal year for posting, uncheck the 'Open' box. You can always open the fiscal year again later by checking the box.

Rename ledger to EG Lønservice

If you have installed the EG Lønservice app and have chosen to import payroll-related entries from the payroll service, remember to change the name of the ledger entry where these entries are imported.

The ledger entry is renamed when the last payroll run for the old fiscal year is posted.

- Note the description of your new fiscal year (Setup > Ledger setup - 'Fiscal periods tab).

- Now go to Setup > Ledger setup, and select the 'ledgers' tab

- Open the ledger by pressing it and rename it to 'EG Payroll Service XXXX', where XXXX is the description of the fiscal year.

Remember to Invite Your Accountant

When you use Xena, you can invite your accountant to be a user in your accounting. This provides many advantages for both you and your accountant! By giving your accountant access via Xena, you've also provided all your documents – it's that simple. If all your documents are electronically attached to Xena, you can actually avoid delivering binders altogether!

Your accountant doesn't need your personal password!

Your accountant needs to have their own Xena account. This way, the accountant can use their personal code for multiple companies. The accountant also doesn't need to access everything in your Xena accounting. When an accountant is invited correctly, Xena only contains the information and options relevant for an audit.

If you want your accountant to also post entries, temporarily assign the 'Bookkeeper' role to your accountant. This type of user costs DKK 159.00 per month and can be removed when the work is completed.

READ MORE: Inviting an Accountant.

Support for Year-End Closing and Getting Started

If you need help beyond what's available on xena.biz, we're here to assist you. However, we can't help with bookkeeping or how to run your business – that's what you can use your accountant for.

- Updated