Limited VAT deduction

When a receipt or invoice specifies a VAT rate of 25%, it is not always possible for you to deduct the entire VAT amount. In Xena, you can customize the VAT deduction as needed.

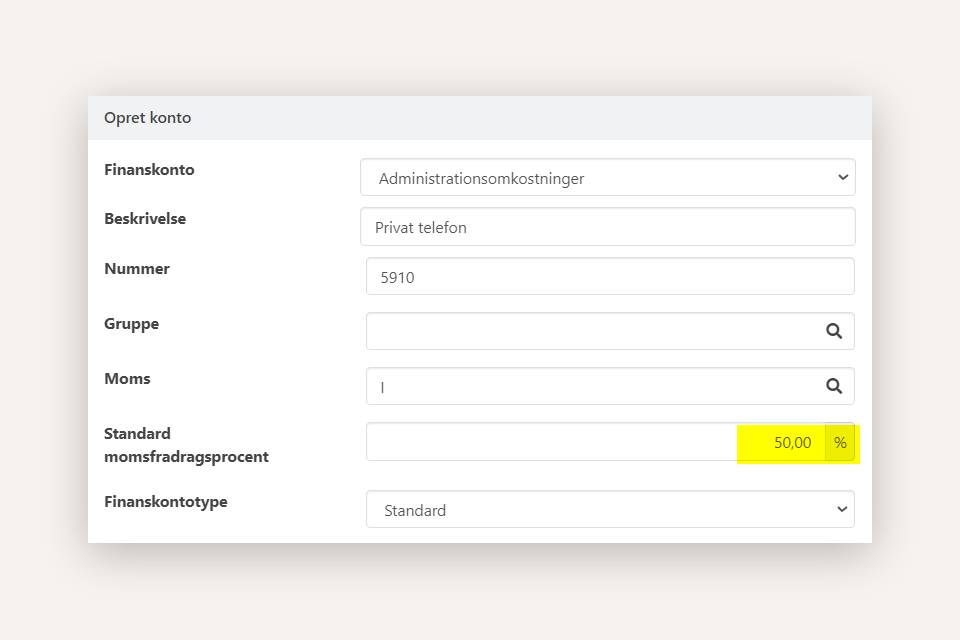

When creating a financial account in Xena, you have the option to define the portion of the VAT amount you wish to deduct for VAT reporting.

- For regular transactions with a full VAT deduction (100%), simply select '100%' in the 'Standard VAT Deduction' field.

- For expenses where only a portion of the VAT is deductible, such as business-related restaurant visits (where you can only deduct 25% of the VAT), you can customize the deduction percentage.

Setting the VAT Deduction Percentage on a ledger account

When creating a ledger account in Xena, enter the desired standard VAT deduction percentage. For example, if you want to deduct half of the VAT, enter '50%'.

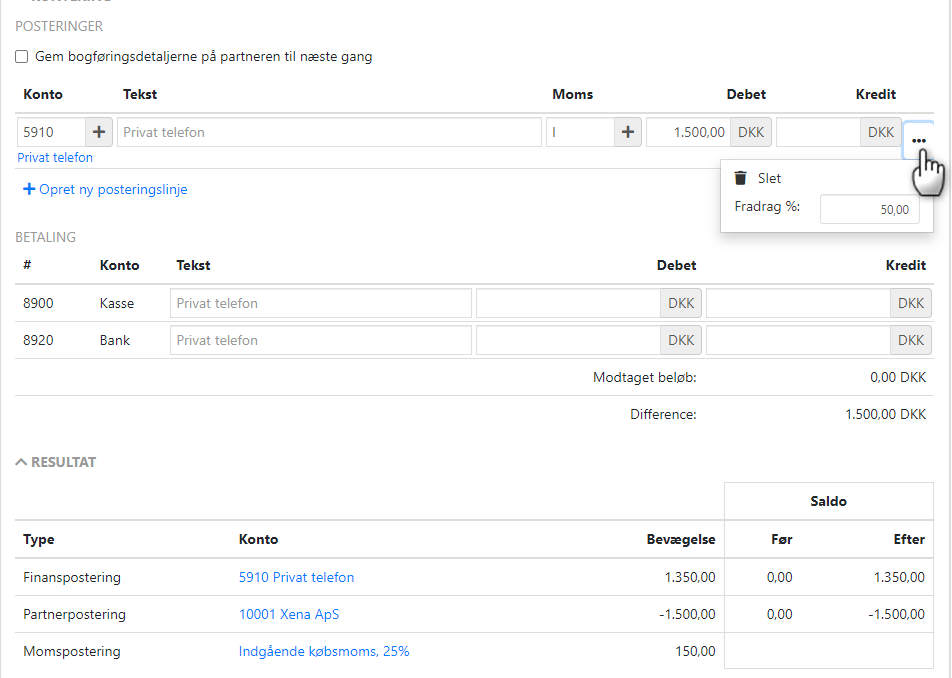

Change VAT deduction when bookkeeping

The selected deduction percentage can always be overridden during the actual accounting on the account, whether you're recording via voucher registration or the ledger entry. To adjust the deduction percentage, simply choose the menu (the three lines) next to the relevant accounting line.

On the "VAT Reconciliation" report, you will see a line for each VAT deduction percentage you have applied to the same financial account. This allows you to have a clear overview of your VAT deductions with different rates.

- Updated