Ledger reports

An overview of the reports you can generate in the ledger module

You can find all reports under Ledger > Ledger Reports.

All reports can be displayed on screen, printed, downloaded, or sent by email using the Report button at the bottom of the window.

Summary

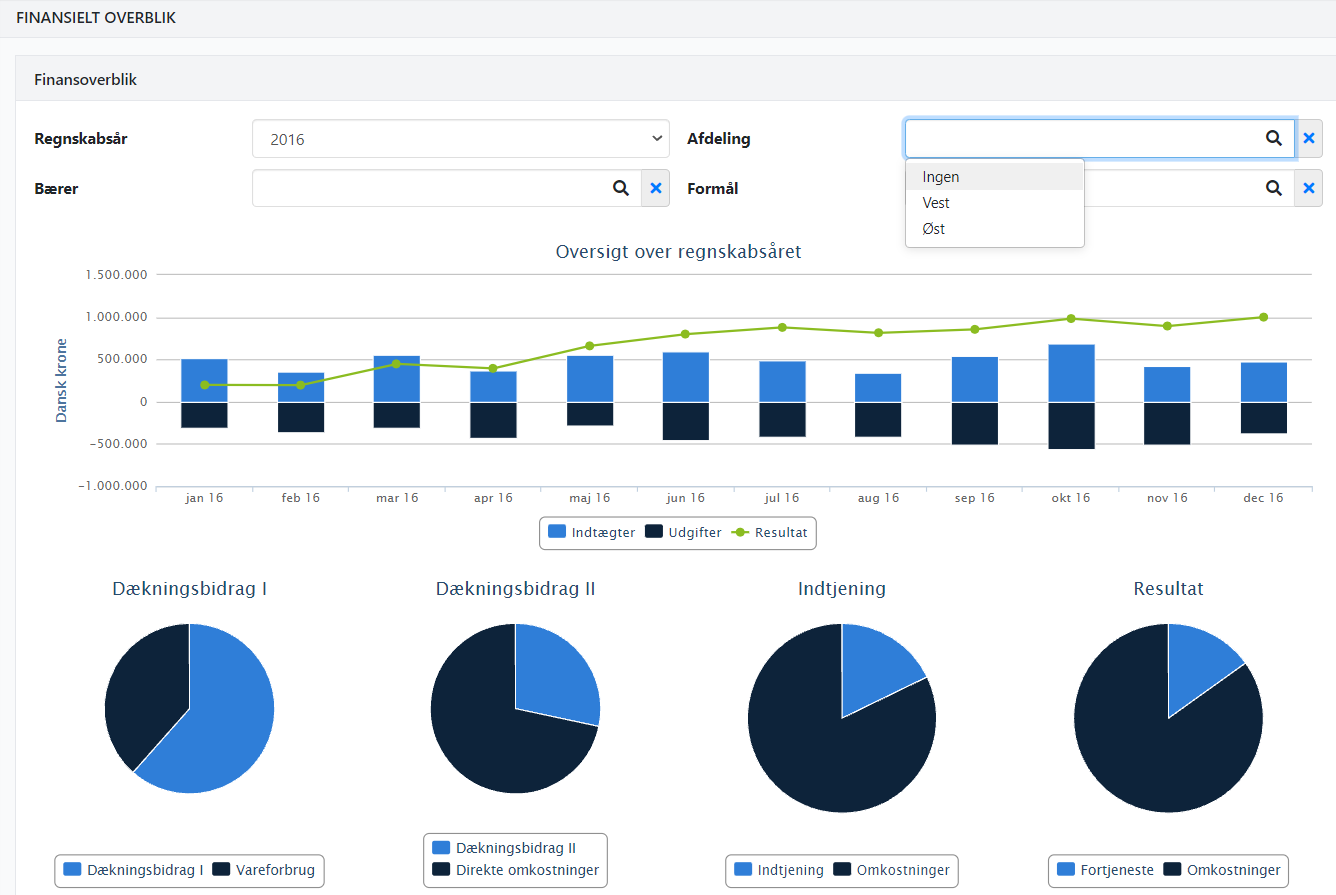

If you want a quick insight into the company’s performance, go to Ledger > Summary.

At the top, a graph shows:

- Light blue bar = Revenue in the current month

- Dark blue bar = Costs in the current month

- Green line = Accumulated result (year to date)

At the bottom of the page, four key figures are shown as charts:

- Margin I = Revenue minus cost of goods sold

- Margin II = Result after direct costs (cost of goods sold, personnel costs, and sales costs)

- Earnings = Result before financial costs (including depreciation, group result, financial items, and tax)

- Revenue = Net result

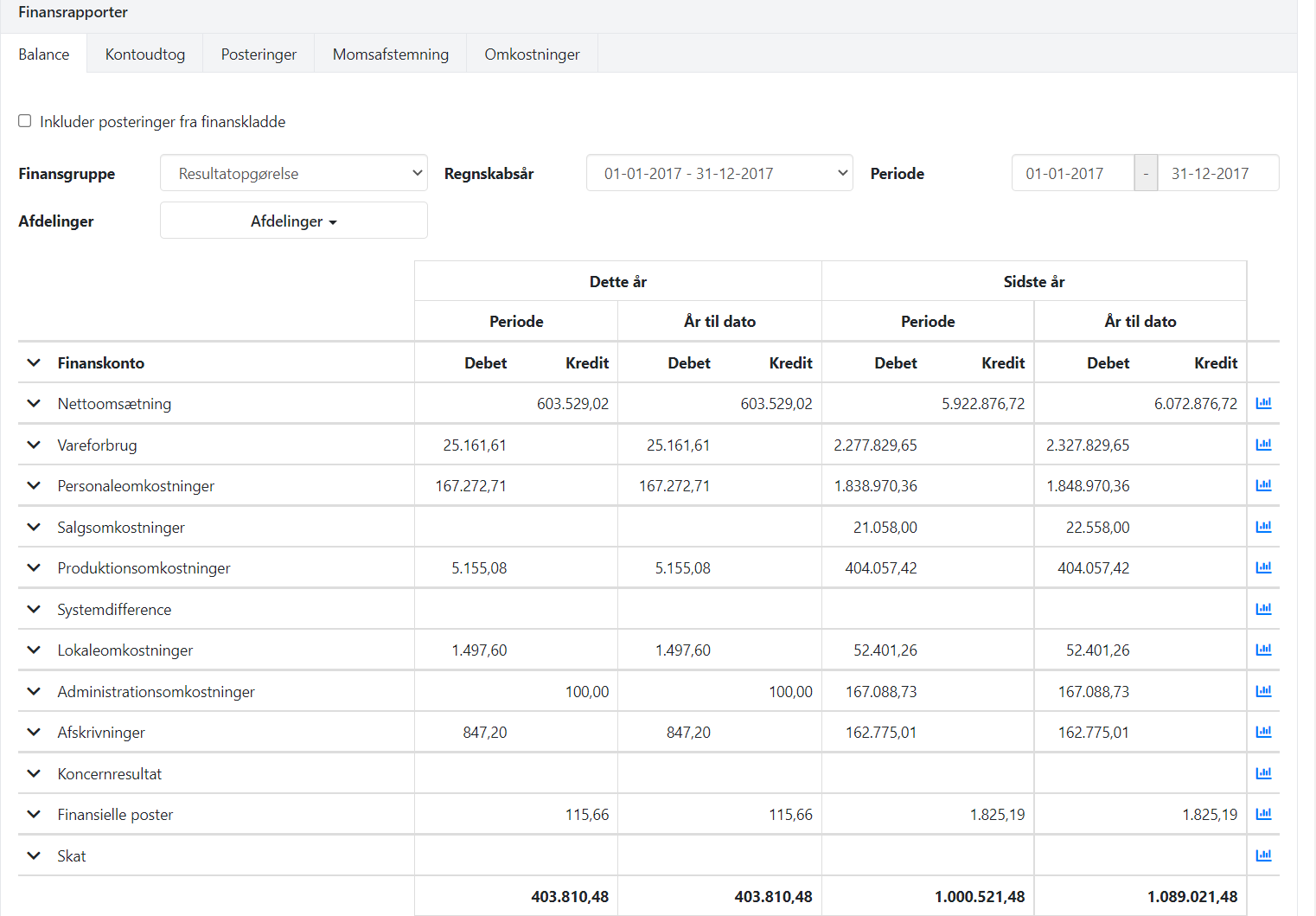

Fiscal balance

The Fiscal balance report shows the balance sheet for the accounts.

When you open the report, you can choose:

- Income

- Assets

- Liabilities

It is possible to include postings from ledgers that have not yet been booked. This is done by selecting the field Include simulatd bookkeeping.

👉 Note: When including postings from the jledger, the calculated VAT amounts per VAT code will not appear in the VAT group. However, the amounts are included in the VAT debt total.

If you are working with dimensions, you can filter the report so that only the desired dimensions are included.

➡️ Read about working with dimensins

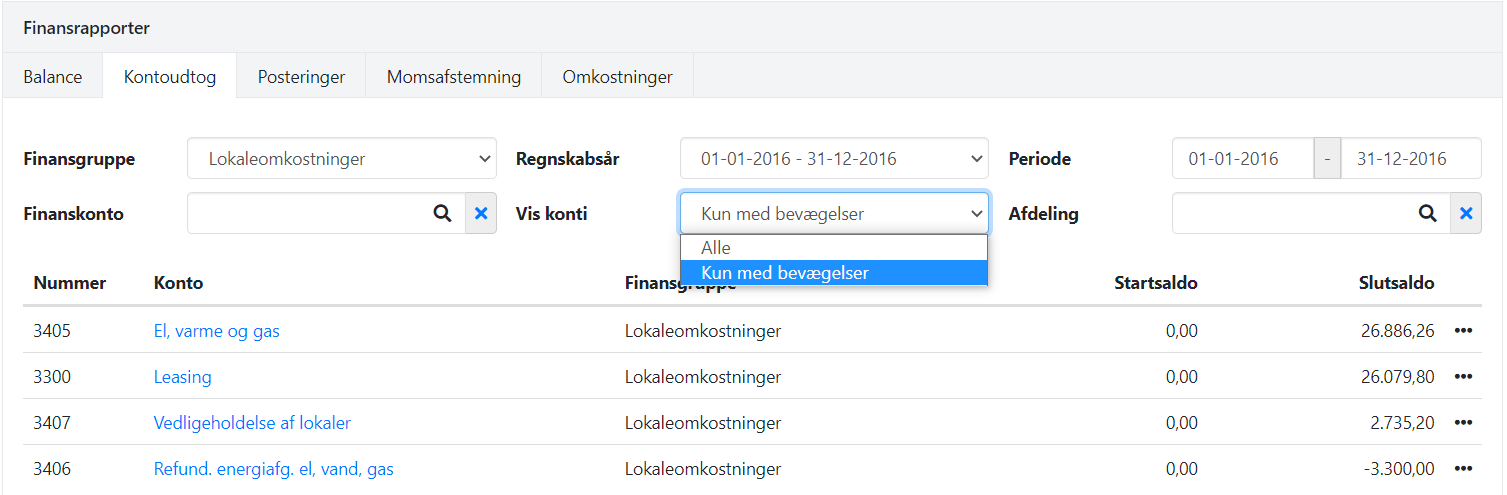

Specifications

The Specifications report provides an overview per ledger account.

At the top, you can filter by e.g. ledger account group or ledger tag. You can also choose to only display accounts with activity in the selected period.

On screen, one line per ledger account is shown (opening and closing balance). When printing the report, the underlying postings for each account are displayed.

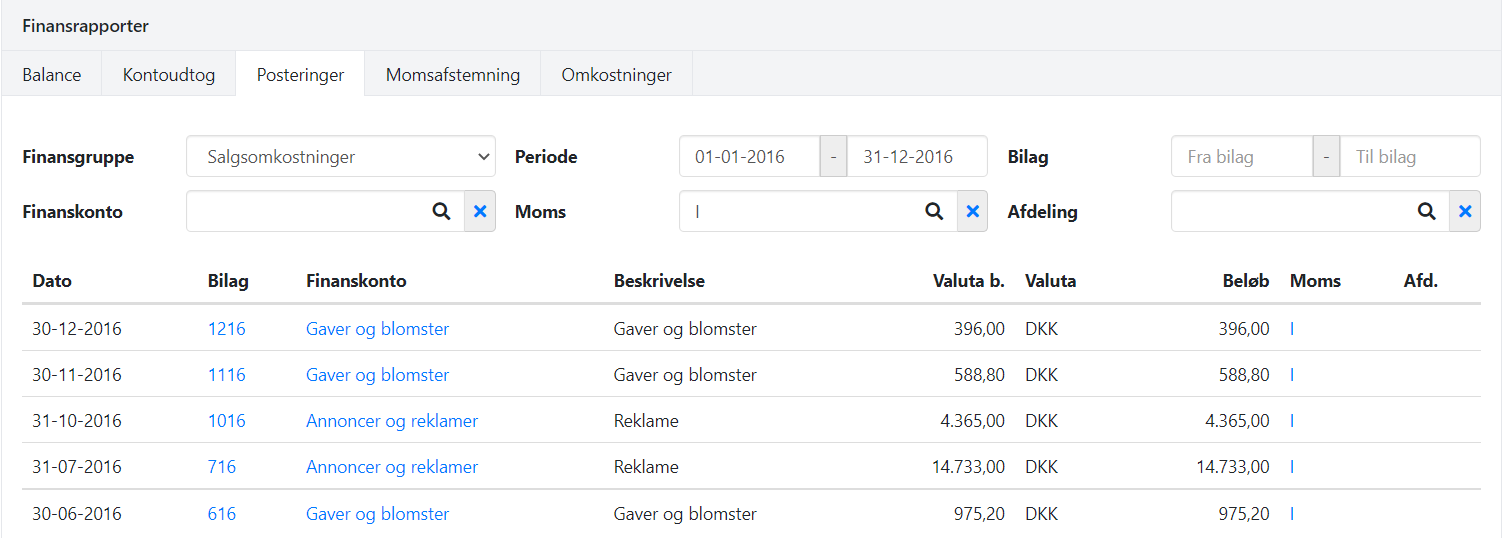

Posts

The Posts report shows booked postings across financial accounts.

At the top, you can filter by several criteria, e.g.:

- Postings with a specific VAT code

- Postings within a specific ledger account group

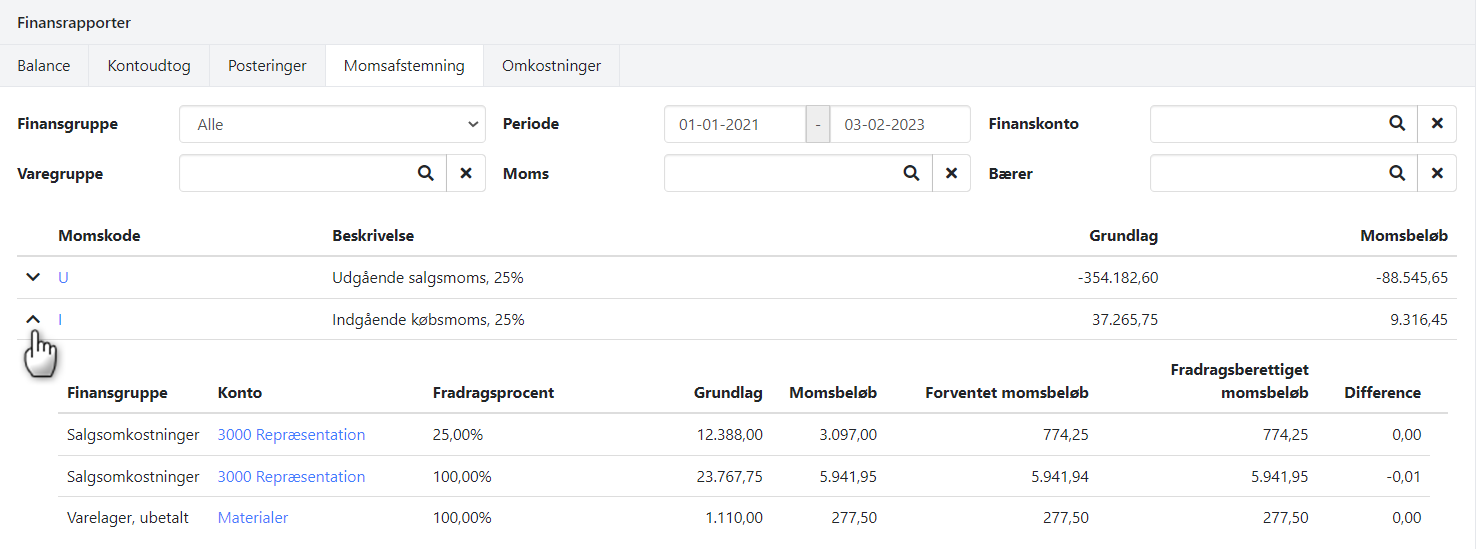

VAT Reconciliation

The VAT Reconciliation report shows the VAT codes that have postings in a selected period.

For each VAT code, the following is shown:

- The basis for the VAT amount

- The booked VAT amount

By expanding the VAT code, you can see details per financial account, including any differences between booked and expected VAT.

👉 Note: If a financial account is booked with two different VAT rates, the account will appear twice in the report.

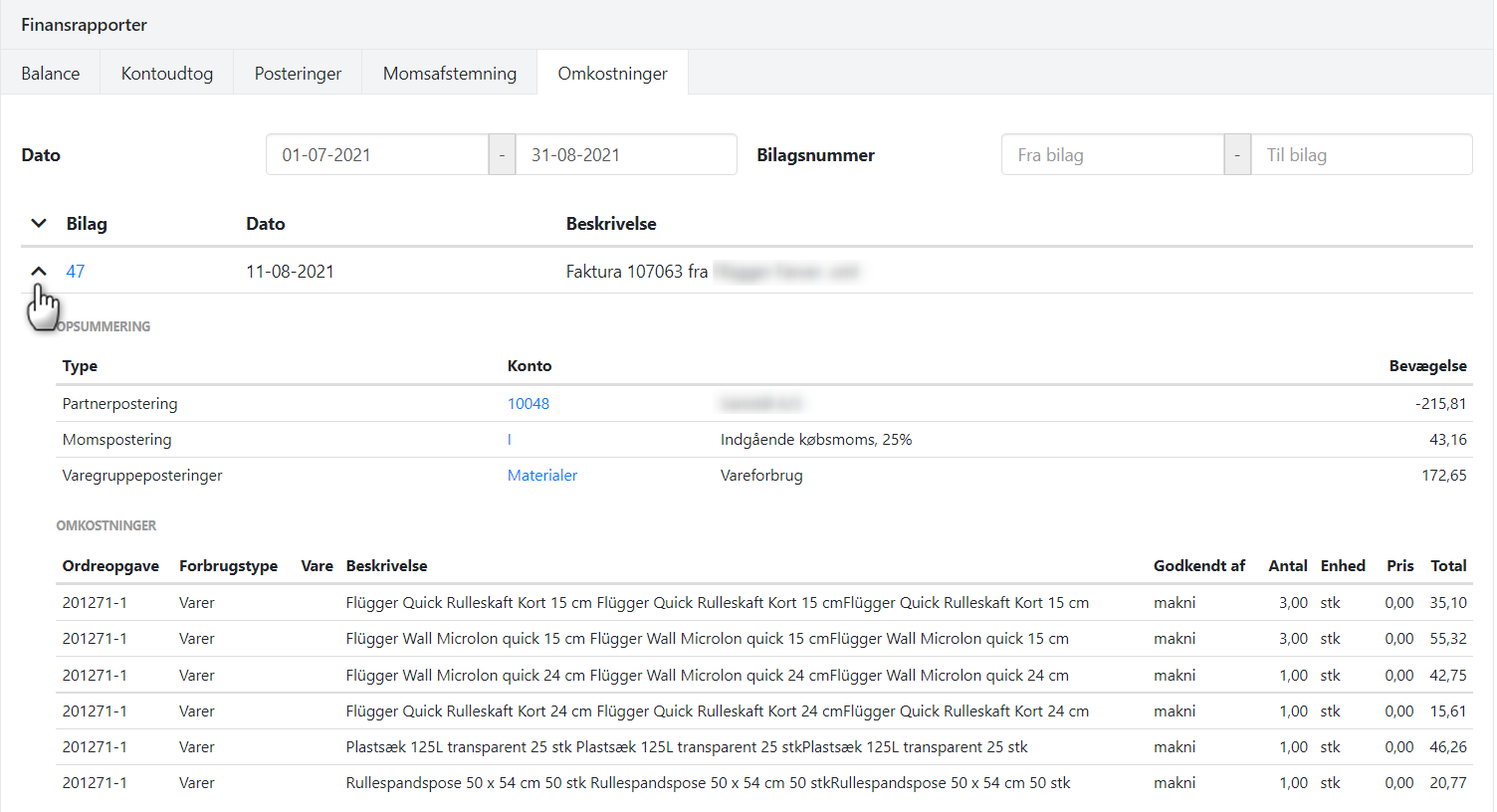

Cost posts

The Expenses report shows vouchers with associated order cost posts for the specified period.

Each voucher can be expanded to view the full posting information, including the order cost posts

➡️ Also read about Automatic Reporting.

- Updated