VAT Reconciliation

How to handle the reconciling of the VAT Report in Xena

Here is a guide on how to reconcile all the columns on the Danish VAT report in Xena.

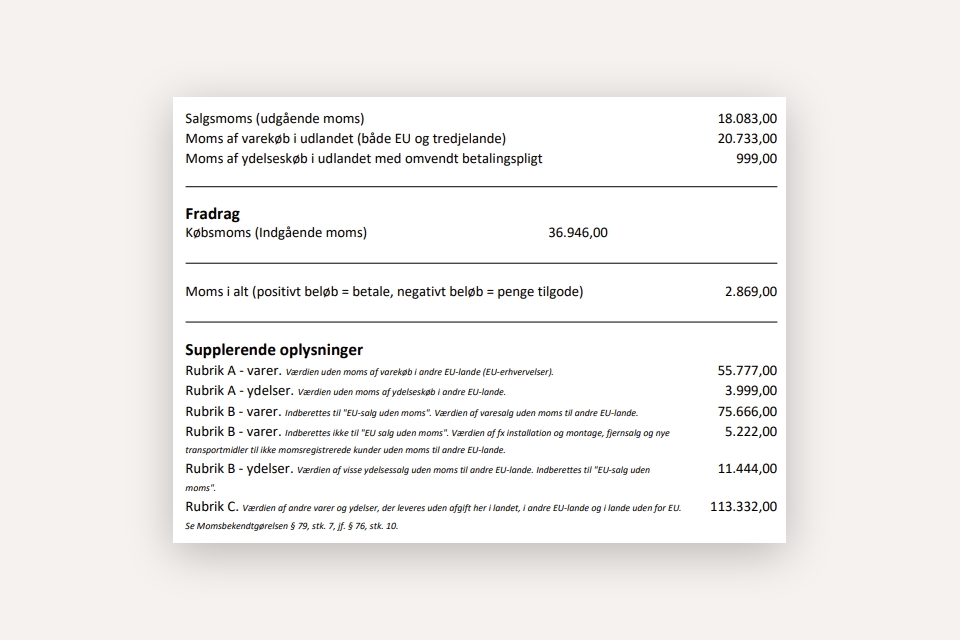

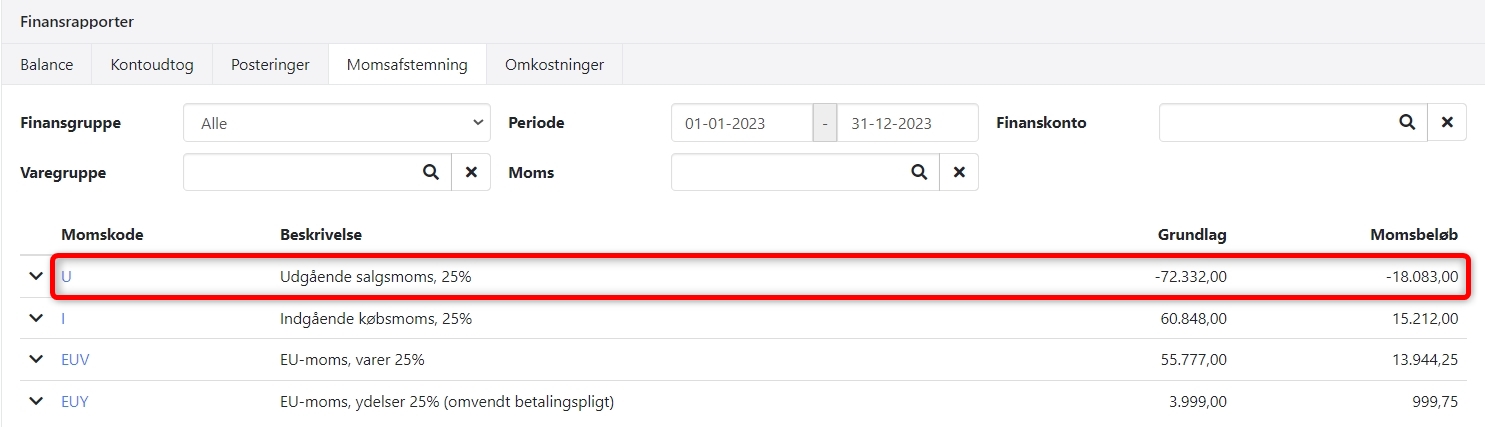

Sales VAT (Outgoing VAT)

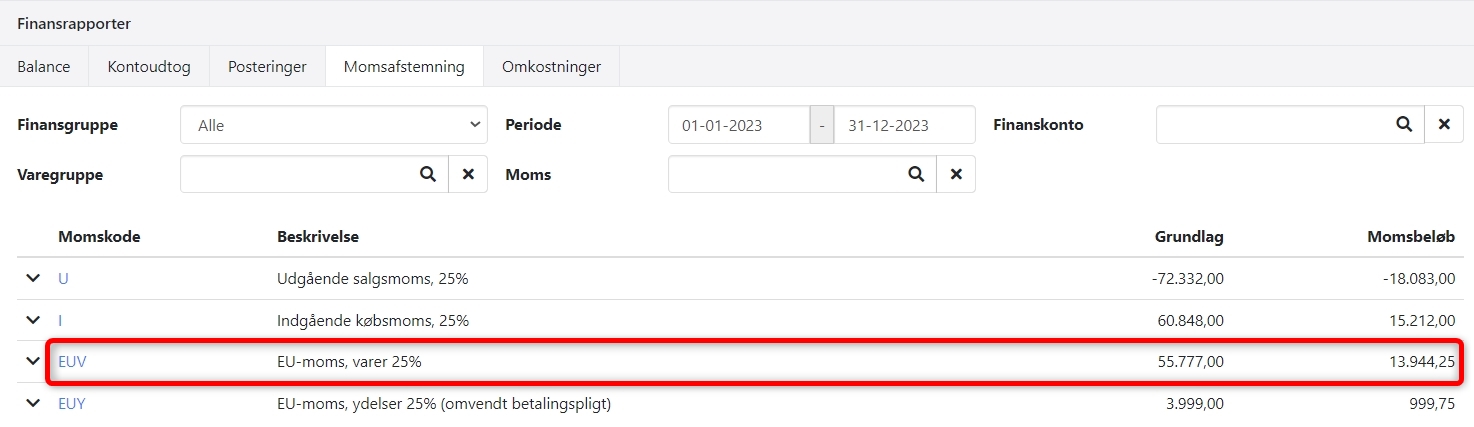

- This figure can be found under Ledger > Ledger reports > VAT Reconciliation.

- It represents the total VAT amount for all tax codes of type 'Sales VAT'.

VAT on Purchases of Goods Abroad (both EU and non-EU)

This VAT amount is a combination of VAT on purchases of goods from EU countries and manually recorded import VAT.

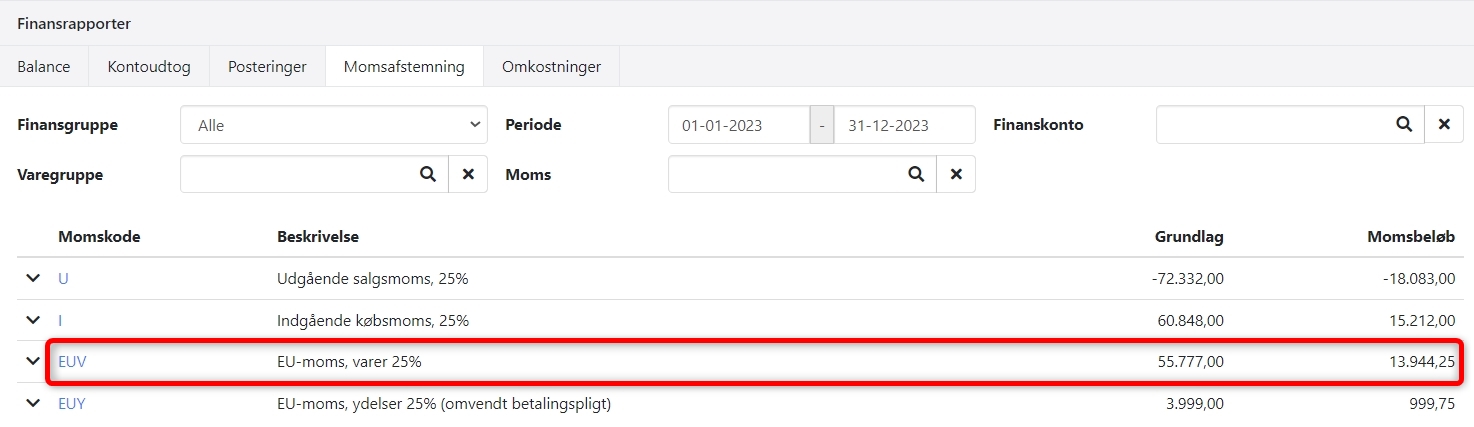

- VAT for purchases of goods from the EU can be found under Ledger > Ledger report > VAT Reconciliation.

- It represents the total VAT amount for all tax codes of type 'EU - Goods'.

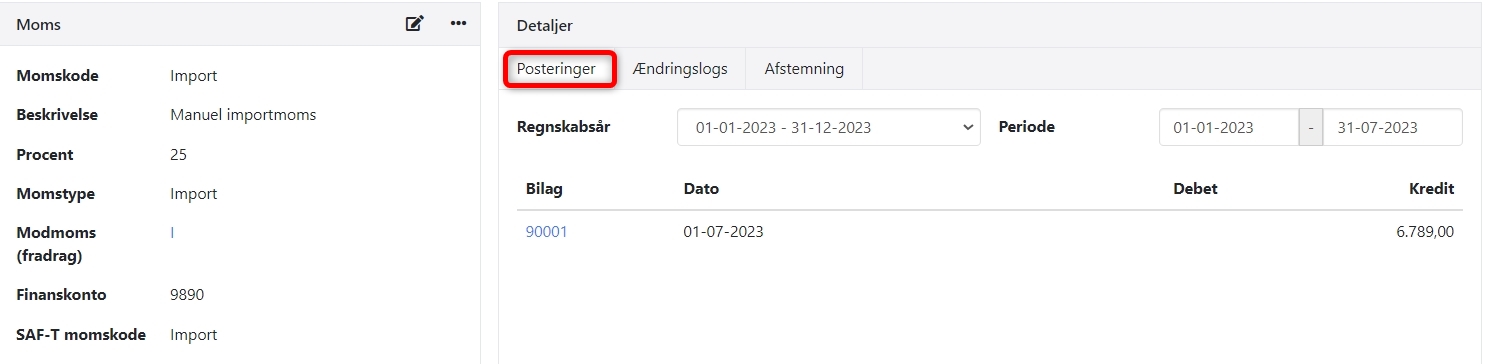

- Manually recorded import VAT can be found through Ledger > VAT > Import VAT settlement, 'Vat Settlements' tab. Open the attachment to find the amount you have posted.

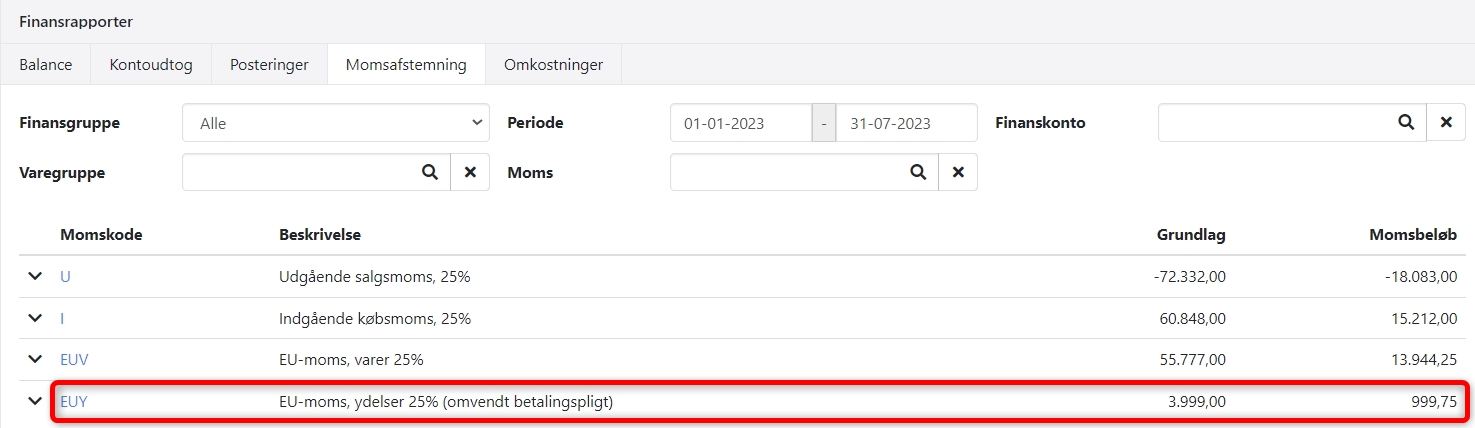

VAT on purchases of services abroad with reverse charge

- This figure can be found under Ledger > Ledger reports > VAT Reconciliation.

- It represents the total VAT amount for all tax codes of type 'EU - Services'.

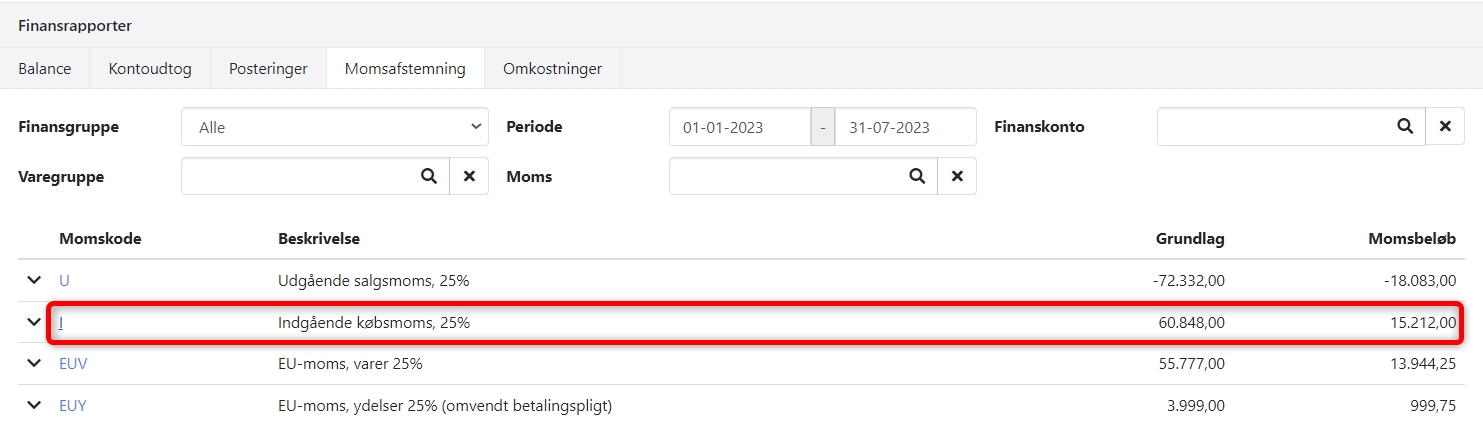

Purchase VAT

- This figure is a combination of standard purchase VAT in Denmark and the sum of the two VAT amounts mentioned above (VAT on purchases of goods from the EU and non-EU + VAT on purchases of services abroad).

- Standard purchase VAT in Denmark can be found under Ledger > Ledger reports > VAT Reconciliation.

- It represents the total VAT amount for all tax codes of type 'Purchase VAT'.

Section A - Purchases of Goods from the EU

- This figure is the total sum of purchases of goods from the EU.

- Find the sum under Ledger > Ledger reports > VAT Reconciliation.

- It forms the basis for all tax codes of type 'EU - Goods'.

Section A - Purchases of Services from the EU

- This figure is the total sum of purchases of services from the EU.

- Find the sum under Ledger > Ledger reports > VAT Reconciliation.

- It forms the basis for all tax codes of type 'EU - Services'.

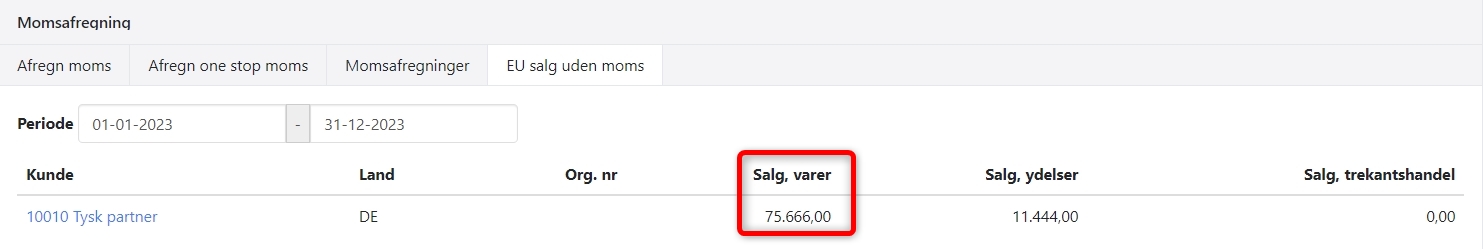

Section B - Reported to EU Sales without VAT

- This figure can be found under Finance > VAT > VAT settlements, 'EU Sales without VAT' tab.

- It represents the net turnover to other EU countries where the product group has EU Grouping = Goods.

Section B - Not Reported to EU Sales without VAT

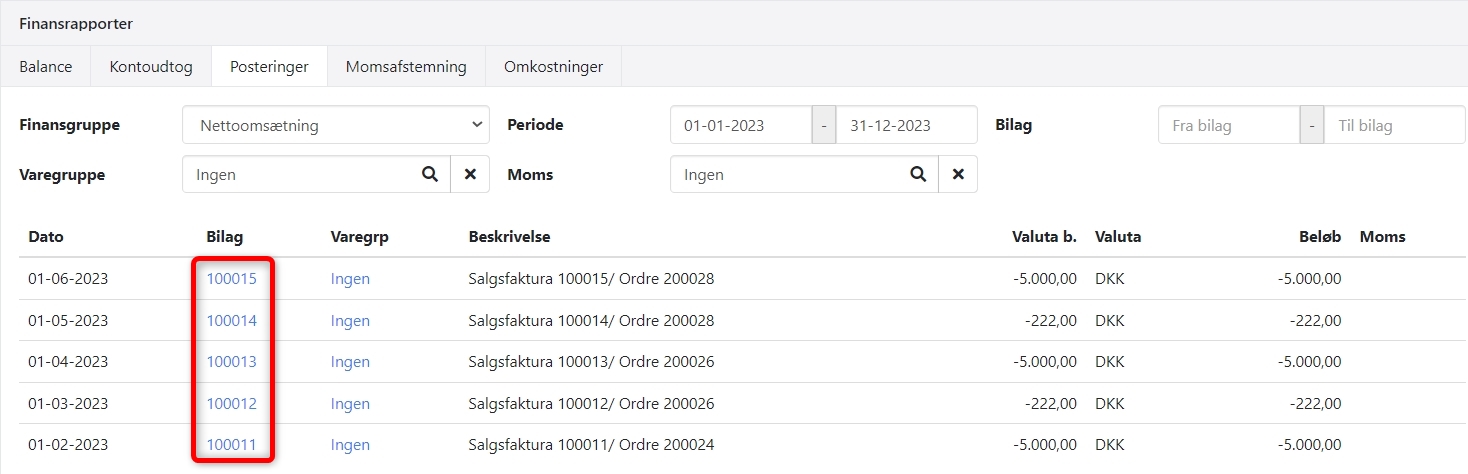

This figure is the total net turnover to other EU countries where the product group has EU Grouping = None. Find the figures under Ledger > Ledger reports > Posts.

- Select 'Net Turnover' at the top.

- Choose the product group where you have selected EU Grouping = None.

- Select 'VAT' = None.

- Remember to select the VAT settlement period.

You can now open the attachments and sum the turnover for the invoices sent to other EU countries.

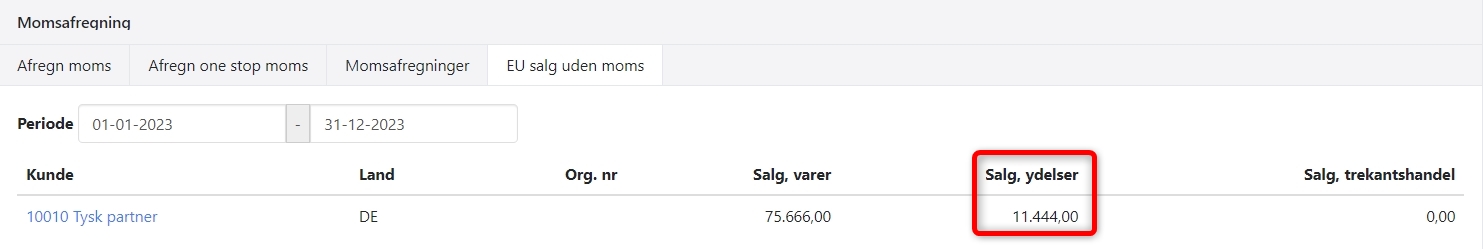

Section B - Sales of Services

- This figure can be found under Finance > VAT > VAT Settlement, 'EU Sales without VAT' tab.

- It represents the net turnover to other EU countries where the product group has EU Grouping = Services.

Section C - Sales to Both DK and Abroad without VAT

Find this figure by locating the total net turnover without VAT and subtracting the figures in the three Section B columns.

Find the total net turnover without VAT under Ledger > Ledger reports > Posts.

- Select 'Net Turnover' at the top.

- Select 'VAT' = None.

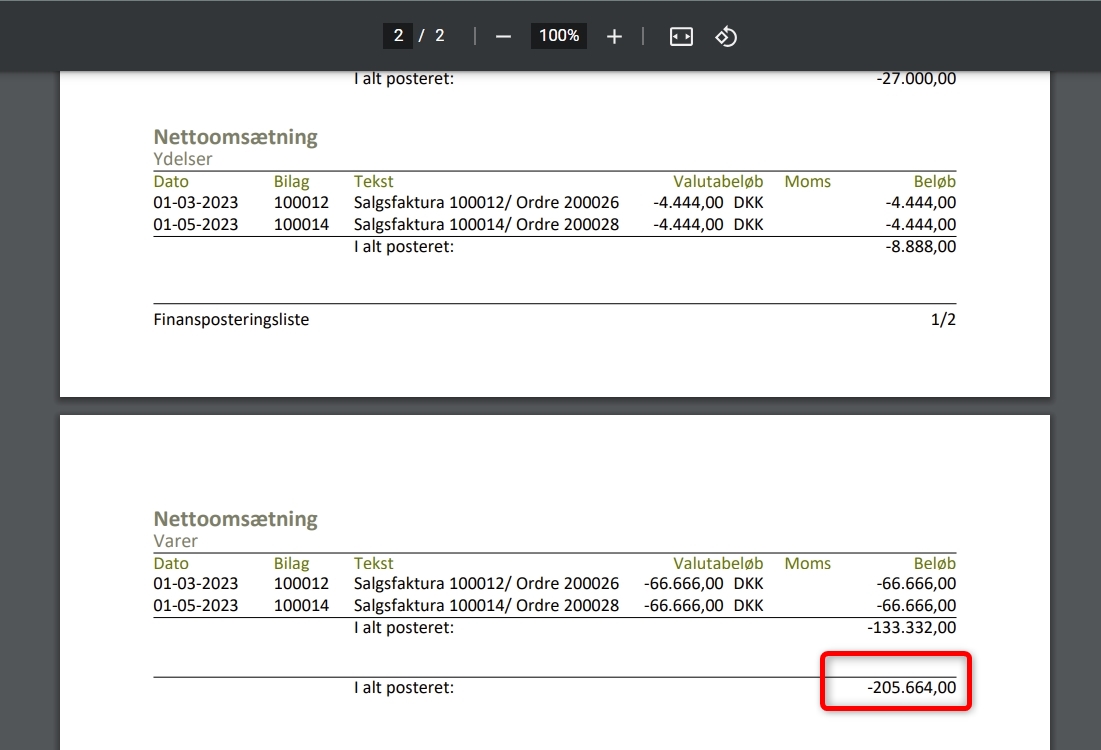

- Remember to select the VAT settlement period.

- Print to PDF and locate the total at the bottom.

- This amount is subtracted from the 3 amounts in column B on the VAT report.

- Updated