Reverse Charge in Xena

Reverse charge is used for trading mobile phones, tablets, laptops, etc

The rules of reverse charge apply to domestic purchases and sales of mobile phones, integrated circuits, game consoles, tablet PCs, and laptops.

Reversed charge means that the seller must issue an invoice without VAT. Instead, the buyer must calculate acquisition VAT but can deduct an equivalent amount as input VAT if the buyer is entitled to full VAT deduction under the general rules. If, for example, the phones or computers can also be used privately by employees, only a partial VAT deduction is allowed.

The reversed charge also applies to trading scrap metal. Companies selling scrap metal, therefore, do not need to charge VAT on the sale. Instead, the buyer of the scrap metal must calculate and pay the VAT.

Purchases with reverse charge

Create a VAT code

If you are a buyer of goods subject to reverse charge, we recommend creating an additional VAT code with a description like 'Acquisition VAT under reverse charge.'

Go to Setup > Ledger Setup and select the 'VATs' tab. Click on the 'Create' button.

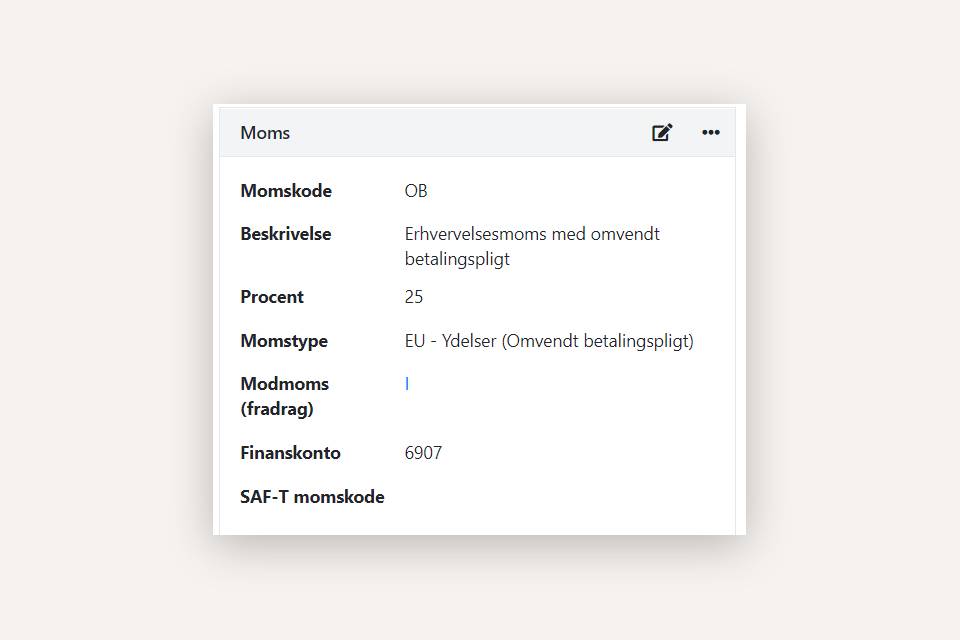

Now create the VAT code; in this example, we'll call it 'RC' for reverse charge:

- Description: 'Acquisition VAT under reverse charge'

- Rate: 25%

- VAT Type: EU Services (Reverse Charge)

- Counter VAT: 'Input VAT (I)'

When reporting VAT to the tax authorities, include the balance of the VAT account 'RC' in the outgoing VAT section. This will be the sum of the regular outgoing VAT plus the acquisition VAT.

Create an article group if necessary

When posting purchases of goods subject to reverse charge, there are several options.

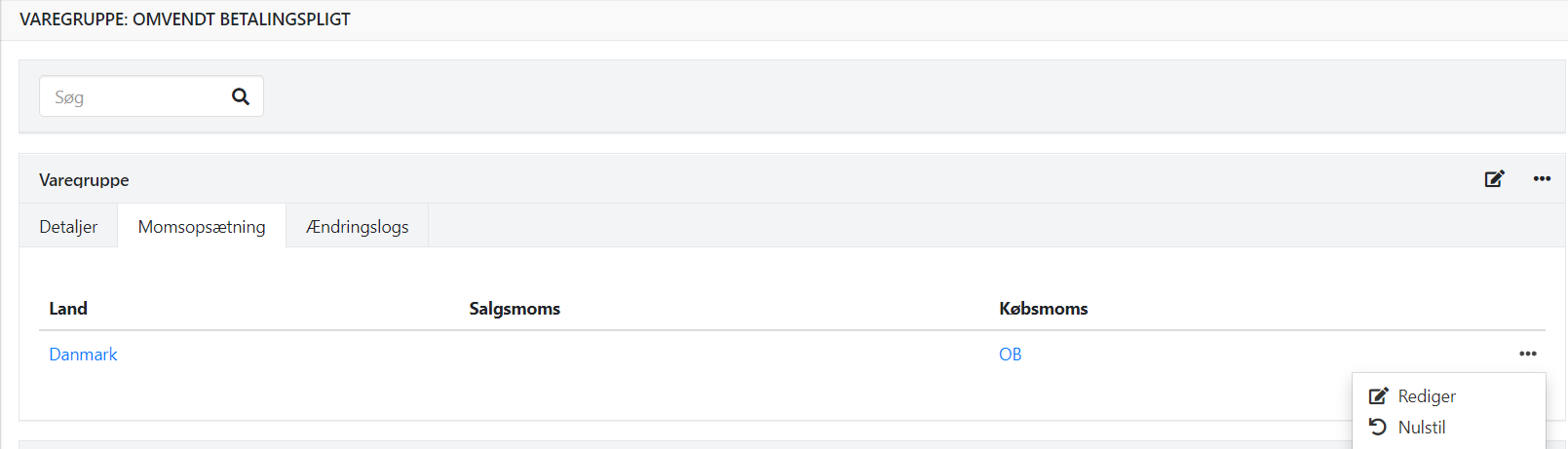

If you want to post purchases and sales of goods covered by the reverse charge rules, first create an additional article group. You can name it, for example, "Goods subject to reverse charge." Specify the VAT code as 'RC' for purchases and leave the VAT code blank for sales (sales are VAT-exempt).

In this article group, you can create the articles you trade within the reverse charge rule. You can now add these articles to your sales and purchase orders, ensuring that the VAT is handled correctly.

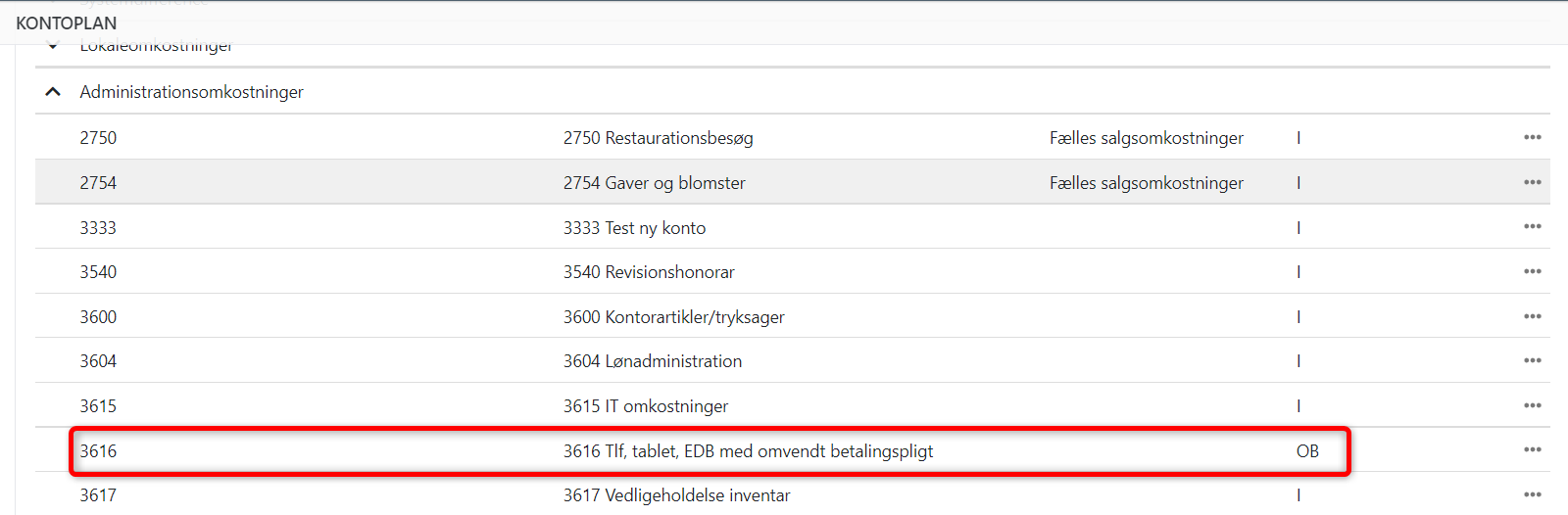

Create a ledger account if necessary

If purchases with reverse charges only need to be financially recorded, you can create a regular ledger account and select the VAT code 'RC.' If the equipment is also used privately and has a private share, remember to set up this financial account with a limited VAT deduction.

Sales with reverse charge

If you are a seller of goods subject to reverse charge, we recommend creating an additional VAT code with a description indicating the type of sale, e.g., "Sale of scrap metal."

Go to Setup > Ledger Setup and select the 'VATs' tab. Click on 'Create.'

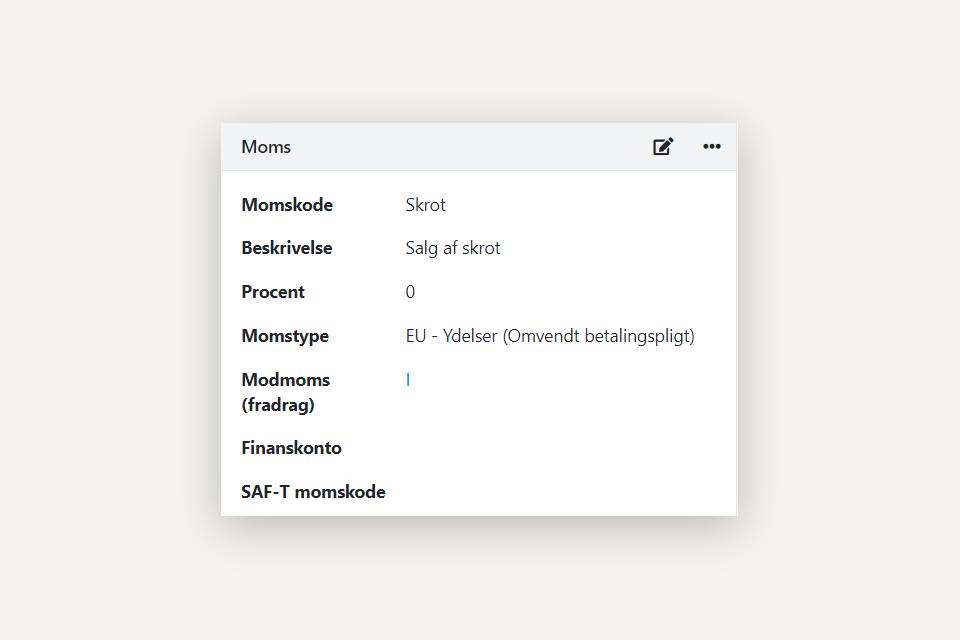

Now create the VAT code; in this example, we'll call it 'Scrap':

- Description: 'Sale of scrap metal'

- Rate: 0%

- Type: EU Services (Reverse Charge)

- Counter VAT: 'Input VAT (I)'

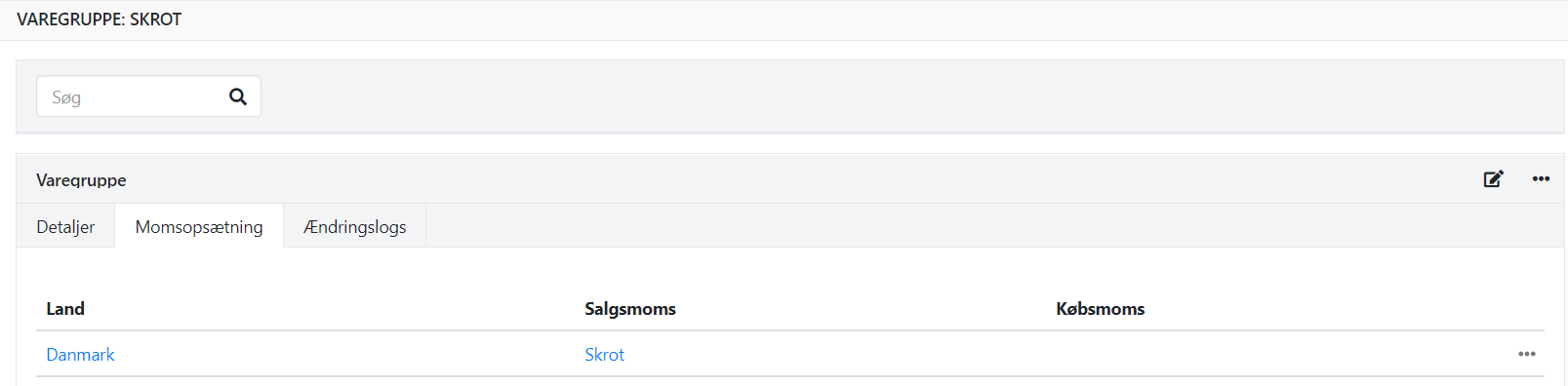

Create an article group

Create an additional article group. You can name it, for example, "Scrap." The VAT code for sales should be 'Scrap,' and the VAT code for purchases should be left blank (purchases are VAT-exempt).

In this article group, you can create the articles you use for selling scrap metal. The articles can now be added to your sales and purchase orders, ensuring that the VAT for the purchase/sale of scrap metal is handled correctly.

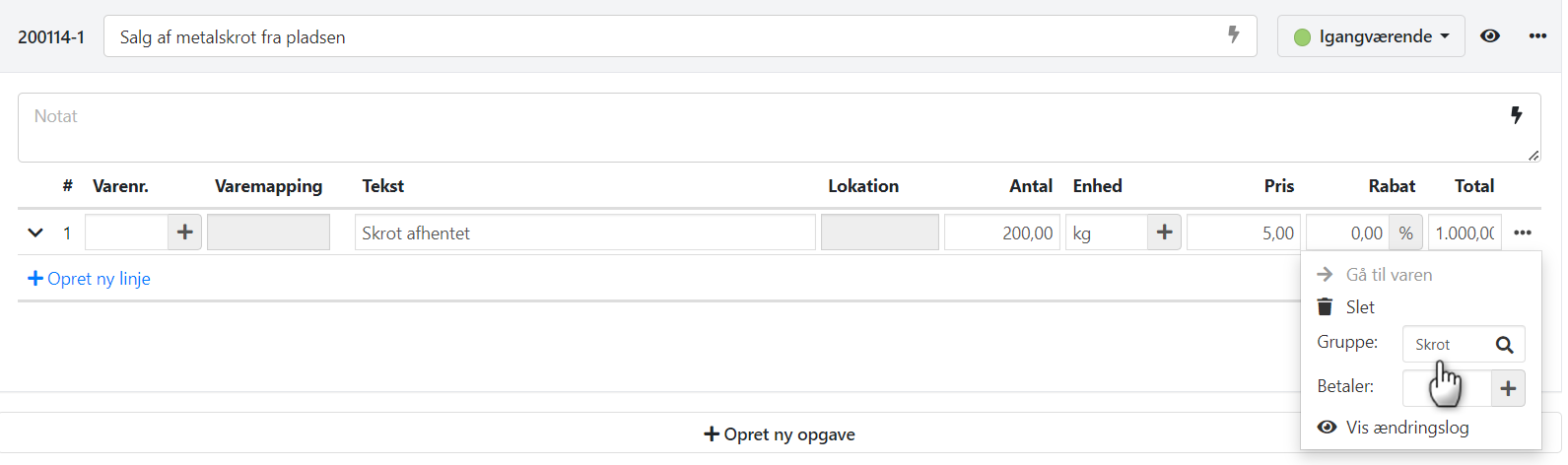

Alternative to articles

If you prefer not to create separate articles for purchases and sales of goods covered by the reverse charge rules, you can simply create article groups for it.

On the order lines, you can manually select the article group.

- Updated