Data Exchange

In this guide, you can briefly learn about the options for exporting data from your Xena fiscal.

In the menu select Setup > Import/Export Data > Data Exchange.

There are 3 different ways to extract data:

- Data Export

- SAF-T

- Regnskab Basis

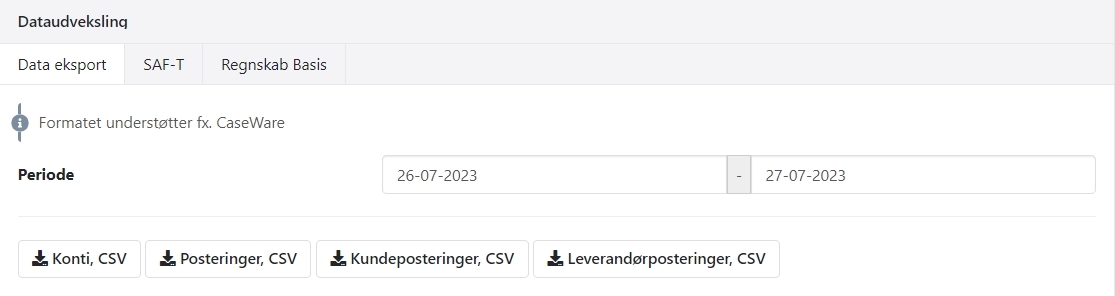

Data Export

Here you can export 4 different CSV files independently. Before exporting the files, you need to specify the period for which you want to extract.

Accounts: Contains the financial accounts with activity in the selected period.

Transactions: Contains financial transactions with both amounts and tax amounts per transaction. For each transaction, a link is provided to open the corresponding voucher in your fiscal.

Customer Transactions/Supplier Transactions: Contains partner transactions, both invoices/credit notes and payments.

SAF-T

Here you can export accounting data for a selected period in SAF-T format. The format follows the requirements of the Danish and Norwegian authorities.

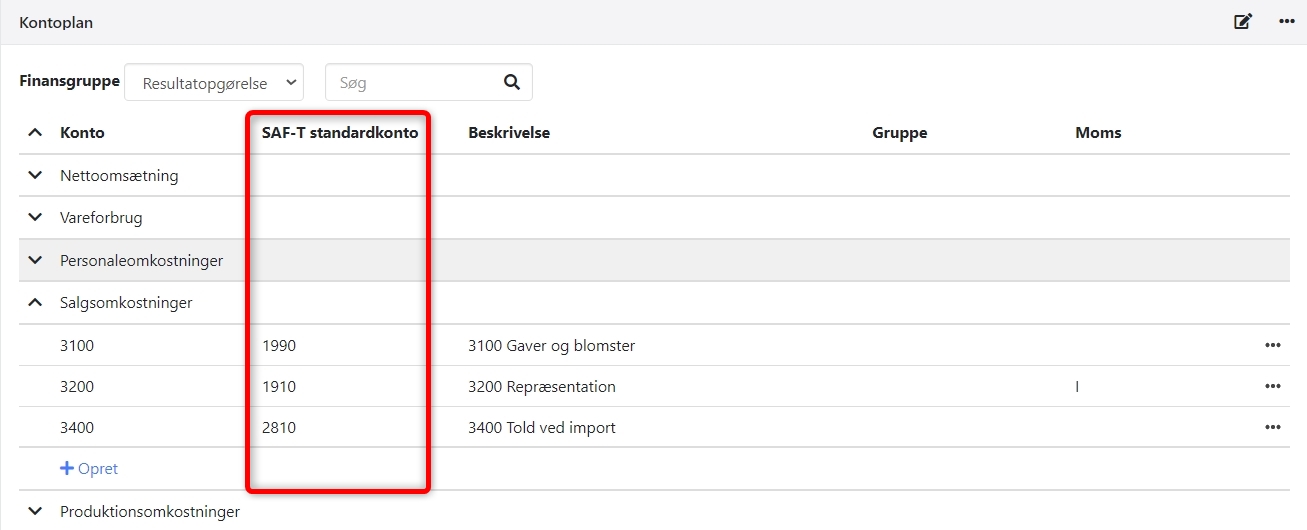

To be able to export the file, all financial accounts with activity in the selected period must have added an account number. You can also choose to add a SAF-T standard account number to all your financial accounts. If this is filled out, it will also be included in the file:

- Open the menu Ledger > Account overview > Account overview

- Expand all accounts (click the arrow next to the 'Account' heading)

- Click the edit icon at the top right

- For each account, enter SAF-T standard account number

- Do the same for both the Income Statement, Assets, and Liabilities

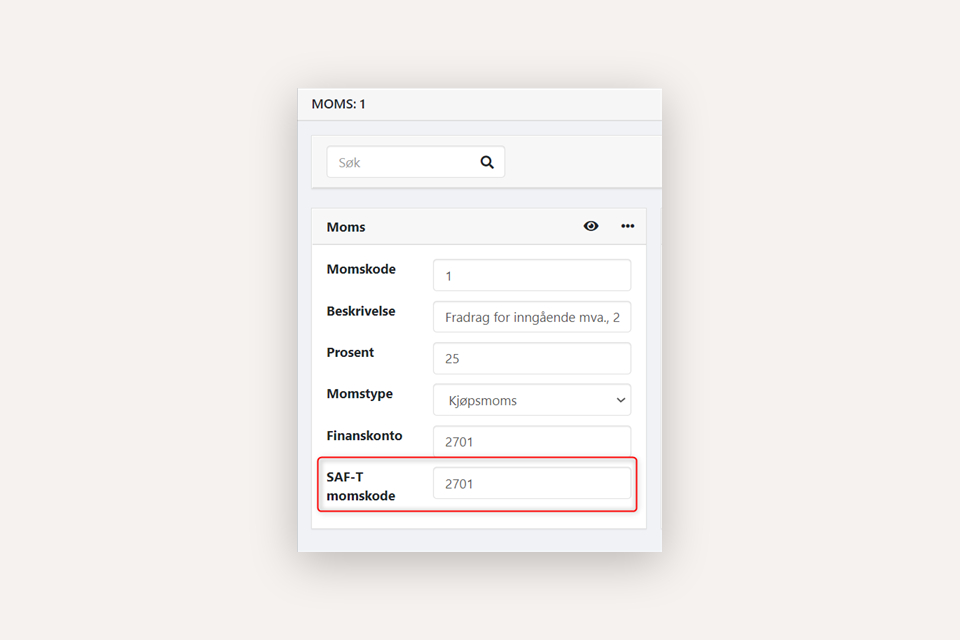

Also for all your VAT codes, you need to enter a SAF-T standard code:

- Open the menu Setup > Ledger Setup, select the tab Vats

- Click on the vat code to open it

- Enter the standard 'SAF-Tv at code' field

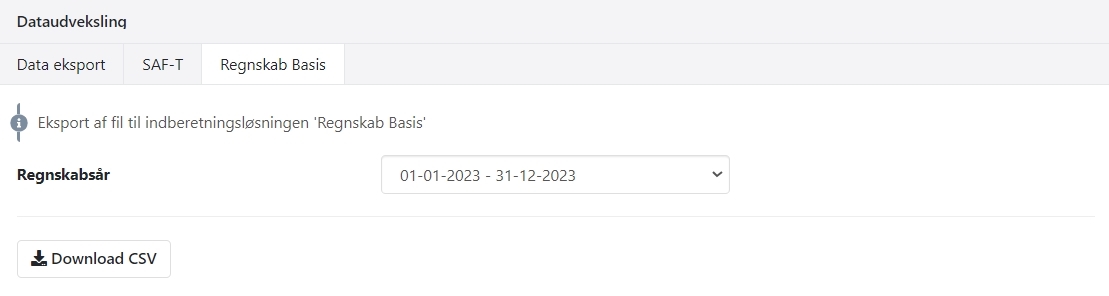

Regnskab Basis

Here you can export financial data in the Danish standard format Regnskab Basis for a chosen fiscal year. The file is in CSV format, and its structure follows the requirements of the Danish authorities.

To be able to extract the file, all ledger accounts with an ending balance in the selected fiscal year must have added the Danish standard account number. Follow steps 1-5 in the 'SAF-T' section.

Link to the guide for the Danish standard chart of accounts

- Updated