Reconciliation of settlements payment solutions

Guide to simplifying the reconciliation of settlements from different credit card solutions

When handling settlements from credit card solution, reconciling these payments can be challenging, especially since bank statements often show a daily aggregated transfer from your terminal provider. Here are some tips to streamline this process.

1: Convert PDF to Excel

In this example, you receive a PDF document containing a summary of payments for a given period.

Use an online tool to convert the PDF document into an Excel file. You can find these tools by searching online.

2: Clean up the Excel File

Once the document is converted into an Excel file, clean it up by removing all unnecessary rows and columns. You should only keep the rows containing information about the date, description, and amount for each payment. Delete all other rows and columns.

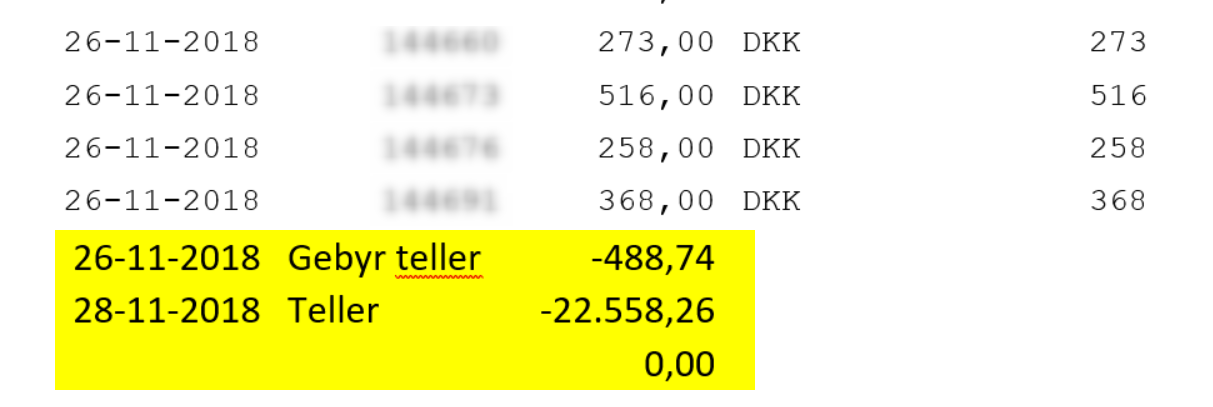

To avoid double-counting bank transfer fees, add two lines at the bottom of the sheet so that the total amount becomes zero:

- A line with the fee you pay for the transfers. The amount should be negative

- A line with the remaining amount, matching the amount deposited into your bank account for the period. This amount should also be negative

The result might look like this:

3: Import to Bank Reconciliation

Save your cleaned Excel file as a CSV file and import it into your bank reconciliation.

When importing the file, do it into the financial account where you reconcile the balance of your credit card payments, such as a MasterCard account.

To further simplify the reconciliation process, it is recommended to install the 'Automatic Reconciliation' app via the Xena Appstore. With this app, Xena can automatically reconcile entries with matching information, such as order numbers.

- Updated